Electric vehicles are a big win over internal combustion engine models in so many ways: superior performance and reduced fueling and maintenance costs. But one area where they lag is higher auto insurance rates.

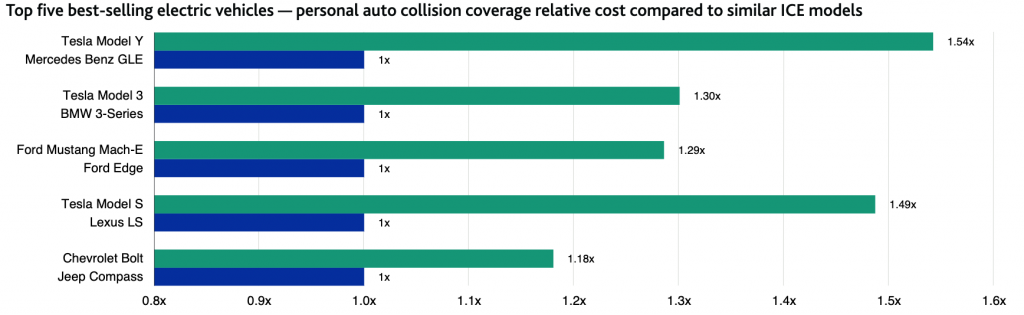

Moody’s just released an analysis of the problem. Here’s their chart showing the disparity in costs for some of the best-selling EVs compared to their gas counterparts:

As the chart shows, the disparity can range from up to 54 percent insurance cost increase between the Tesla Model Y and Mercedes GLE to 18 percent increase between the Chevrolet Bolt and Jeep Compass — lower but still more than the gas version.

Why is this happening? It’s mostly attributable to higher repair costs when there is an accident. In short, the battery is the most expensive part of the vehicle and therefore costly to replace. As a result, many EVs are declared a total loss after a collision. And while EVs have a lower risk of fires than gas cars, EV fires are harder to extinguish. They also tend to happen when a vehicle is parked, meaning the damage can spread to garages and other buildings.

In addition, EVs are heavier than gas cars and can therefore cause more damage in a collision. Finally, many auto repair shops don’t have the expertise and equipment to repair electric vehicles, which drives up cost.

But this added cost is not necessarily a permanent feature. As battery prices decrease, replacement will be less of a burden after a collision. And more repair shops will be able to handle the work, which will decrease costs as well. Both of these factors should eventually help address the insurance issue, which is a somewhat hidden but important financial challenge to address if we want to see EVs available to all.