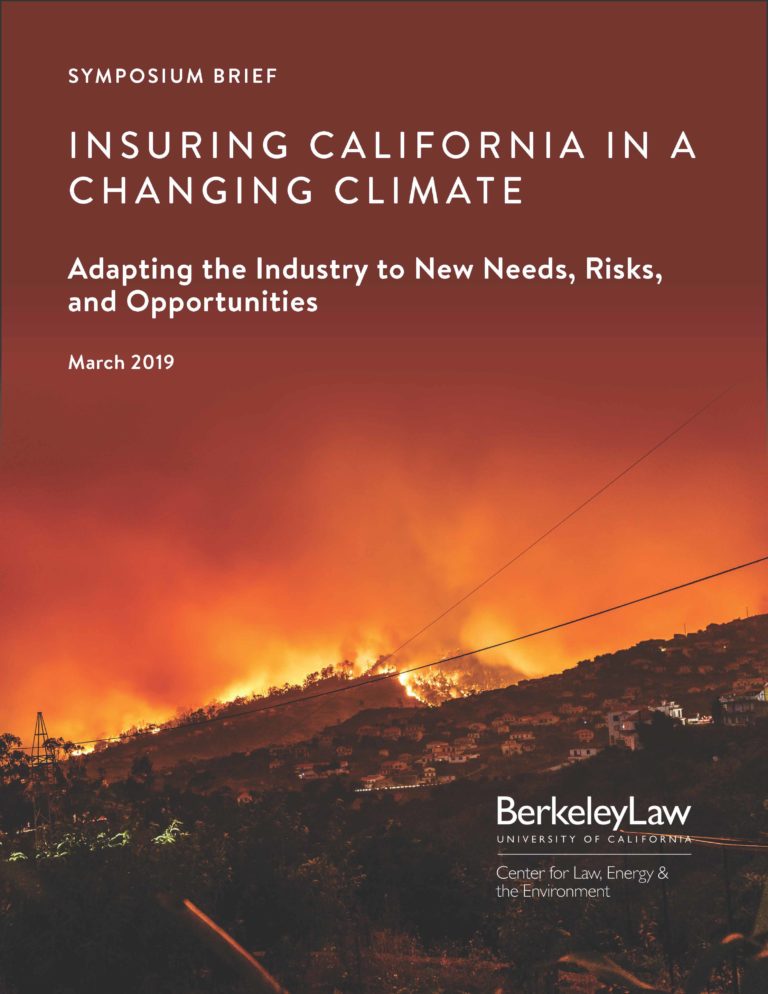

Last year, Berkeley Law’s Center for Law, Energy & the Environment (CLEE) convened a symposium with a keynote address by Insurance Commissioner Dave Jones (now Director of CLEE’s Climate Risk Initiative), which featured insight and analysis of the role the insurance industry will play in a changing climate. CLEE is now releasing a symposium brief to present the key findings from the event, along with top recommendations for industry and policy makers. Download the symposium brief here.

The brief highlights key discussion points from the expert panels we convened on: climate science and insurance modeling; legal liability and climate change litigation; vulnerability of insurers’ assets and financial markets; innovative insurance products and proactive investments; and insurance affordability and availability.

Among the recommendations for state and industry leaders detailed in the symposium brief:

- Require insurers to employ increasingly detailed and comprehensive catastrophe models that accurately assess evolving wildfire and other risks while suggesting potential mitigation measures;

- Enhance disclosure of corporate and insurer risks due to climate change to increase transparency and decrease litigation risks;

- Develop carbon supply curves that map economic transition scenarios for specific market sectors;

- Offer innovative insurance products that can incentivize risk reduction, such as coverage upgrades for fire-hardened structures and discounts for green buildings; and

- Craft legislative reforms to ensure affordability and availability in all communities, like mandatory renewal offers for properties that meet mitigation and defensible-space requirements.

Many of the solutions discussed at the symposium (and in our comprehensive 2018 report Trial by Fire) have since been incorporated into law, including measures like SB 824 (Lara, 2018, limiting blanket policy cancellations following a major disaster event) and SB 30 (Lara, 2018, convening a working group to support ecosystem restoration-based insurance initiatives). As California experiences more concrete and consistent impacts of climate change, continued discussion of these solutions will become ever more essential.

CLEE will host a free webinar this morning at 10am (Wednesday, March 27th) to discuss the new symposium brief and officially welcome Dave Jones to CLEE. Please join us to hear his perspective on the issues covered in the brief, as well as the broader role of the insurance and financial sectors in a changing climate.

Commissioner Dave Jones just concluded two successful terms leading the California Department of Insurance, where he distinguished himself as a pioneer in efforts to address the risks that climate change poses to the insurance sector. The Center for Law, Energy and the Environment (CLEE) at Berkeley Law is now pleased to welcome him to our team, where he plans to expand on this groundbreaking work.

You can join us at CLEE in welcoming Dave Jones at a free webinar this Wednesday, March 27, at 10am to learn more about his work and perspective on climate change, insurance, and financial risks.

At CLEE, Jones will launch a new initiative to develop smart public policy to help the insurance and other financial sectors better identify, evaluate, and address climate risk. He will also examine the role that the financial sector can play in aligning capital with the Paris Agreement and the role of financial regulators in addressing climate related risks.

Jones previously collaborated with CLEE while in office, including on our September 2018 report Trial by Fire and a June 2018 symposium Insuring California in a Changing Climate. During our webinar this Wednesday, we will launch a new brief based on the symposium that summarizes the top analysis and recommendations from participants.

Jones will draw heavily from his pioneering efforts as Insurance Commissioner in this new initiative at CLEE. Under his leadership, the Department of Insurance launched the Climate Risk Carbon Initiative, a first-of-its-kind effort requiring major insurers to disclose their fossil fuel investments and requesting that they divest from thermal coal enterprises. Jones additionally spearheaded groundbreaking climate risk scenario analyses of insurers’ investment portfolios to assess the potential exposure to climate-related risks of trillions of dollars of insurer investments. Jones was also founding Chairperson of the Sustainable Insurance Forum, a working group of insurance regulators from across the globe developing best supervisory practices to address climate risk.

I hope you can join Wednesday’s webinar to learn more about Jones’ new work on this important issue at CLEE, as well as what the insurance industry can do to address and incorporate climate risks going forward.