On Today’s Your Call, we’ll discuss how the ongoing fires in Los Angeles will affect the home insurance market. Joining us will be:

- Dave Jones, the Director of the Climate Risk Initiative at UC Berkeley’s Center for Law, Energy and the Environment (CLEE), who served two terms as California’s Insurance Commissioner from 2011 to 2018

- Jake Bittle, staff writer at Grist covering disasters and climate adaptation, and the author of the 2023 book: The Great Displacement: Climate Change and the Next American Migration

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 10am PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

Electric vehicles are a big win over internal combustion engine models in so many ways: superior performance and reduced fueling and maintenance costs. But one area where they lag is higher auto insurance rates.

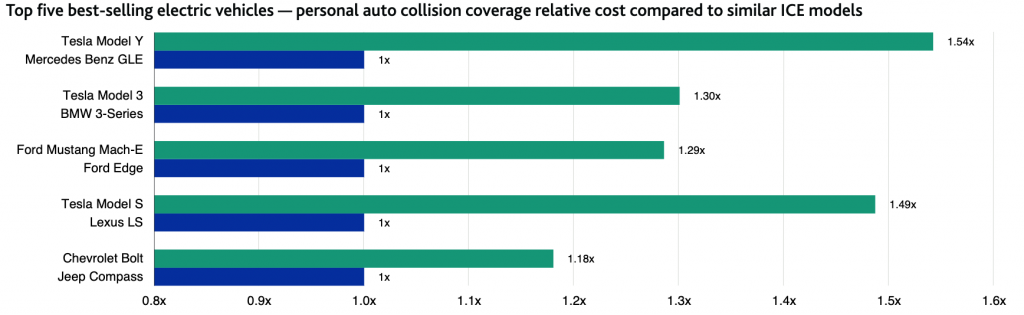

Moody’s just released an analysis of the problem. Here’s their chart showing the disparity in costs for some of the best-selling EVs compared to their gas counterparts:

As the chart shows, the disparity can range from up to 54 percent insurance cost increase between the Tesla Model Y and Mercedes GLE to 18 percent increase between the Chevrolet Bolt and Jeep Compass — lower but still more than the gas version.

Why is this happening? It’s mostly attributable to higher repair costs when there is an accident. In short, the battery is the most expensive part of the vehicle and therefore costly to replace. As a result, many EVs are declared a total loss after a collision. And while EVs have a lower risk of fires than gas cars, EV fires are harder to extinguish. They also tend to happen when a vehicle is parked, meaning the damage can spread to garages and other buildings.

In addition, EVs are heavier than gas cars and can therefore cause more damage in a collision. Finally, many auto repair shops don’t have the expertise and equipment to repair electric vehicles, which drives up cost.

But this added cost is not necessarily a permanent feature. As battery prices decrease, replacement will be less of a burden after a collision. And more repair shops will be able to handle the work, which will decrease costs as well. Both of these factors should eventually help address the insurance issue, which is a somewhat hidden but important financial challenge to address if we want to see EVs available to all.

Climate change presents a wide range of risks to California’s insurance industry, as Californians across the state contend with unprecedented wildfires, changing storm patterns, increased risks of flooding and sea level rise, and disruptions to business from agriculture to fisheries and beyond. Potential decarbonization of the economy and litigation based on climate-related damages further threaten the insurance business model. The industry faces these dynamic challenges at the same time that insurance products are becoming more necessary but less available and affordable.

Climate change presents a wide range of risks to California’s insurance industry, as Californians across the state contend with unprecedented wildfires, changing storm patterns, increased risks of flooding and sea level rise, and disruptions to business from agriculture to fisheries and beyond. Potential decarbonization of the economy and litigation based on climate-related damages further threaten the insurance business model. The industry faces these dynamic challenges at the same time that insurance products are becoming more necessary but less available and affordable.

To tackle these issues, the California Department of Insurance (CDI), under the leadership of Commissioner Dave Jones, has spearheaded efforts to drive insurers to disclose climate risks, divest of fossil fuel-related investments, and maintain access to insurance in vulnerable areas.

Today, CDI and Berkeley Law’s Center for Law, Energy and the Environment (CLEE), together with lead author Dr. Evan Mills, released Trial by Fire: Managing Climate Risks Facing Insurers in the Golden State, a comprehensive report documenting the nature and extent of the risks and opportunities faced by insurers and residents in California. The report covers:

- CDI’s landmark efforts to date;

- Physical, transition, and liability risks;

- Challenges to insurance affordability, adequacy, and availability;

- The opportunities presented by “green” insurance products;

- Potential legislative and policy reforms; and

- Solutions for industry, regulators, and consumers to preserve a viable insurance industry in a changing climate.

Many of the points covered in the report also dovetail with a June 2018 CLEE-hosted symposium with stakeholders across California’s insurance and climate regulatory communities. Building from this symposium and CDI’s ongoing climate change initiatives, Trial by Fire documents the challenges faced by an industry essential to the fight against climate change and provides a roadmap for California leaders seeking to engage and support it.

The full report is available here.

Video of Commissioner Dave Jones’ press conference this morning announcing 2018 wildfire insurance loss data and the release of the report is available here.

CDI’s press release announcing the report is available here.