Analysts are predicting a bright future for battery costs, thanks in large part to Tesla’s under-construction Gigafactory in Nevada:

Tesla’s grid battery, the Powerwall, is currently priced at about $250/kWh, but CTO JB Strabuel said at a recent utility conference that he expects that price to drop to about $100/kWh by the end of the decade as the company ramps up production.

That ambitious estimate is now being approached by other analyst predictions.

“Our detailed battery component cost analysis details a path to 50%+ reduction in battery pack cost to $125/kWh by 2020,” [Jefferies analyst Dan] Dolov said, according to StreetInsider. Jefferies expects the battery cells themselves to reach about $88/kWh by the end of the decade, and the battery packs to reach about $38/kWh.

A 50% reduction by 2020 would be monumental for the electric vehicle industry. Imagine double the range of current all-battery vehicles at the same price tag ($30K or so for the LEAF, for example). Imagine a high-end Tesla at $20-30K off the current price.

It’s worth keeping in mind that these predictions are only about 2020. By 2030, when we need all new vehicles to be battery-electric to meet our climate goals, prices should come down even more, while public charging infrastructure will only improve.

And as I’ve said before, it’s not just about transportation. These batteries will be needed in bulk to store surplus solar and wind power to decarbonize the grid.

Basically, if you care about climate change, these kind of price forecasts are the most important pieces of news in the field.

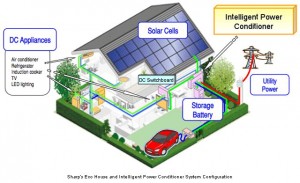

The Washington Post picks up on the thread of how valuable energy storage (i.e. batteries) can be for the grid when paired with solar panels:

The Washington Post picks up on the thread of how valuable energy storage (i.e. batteries) can be for the grid when paired with solar panels:

So is it happening? The answer seems to be yes — 2015 has seen several key announced, completed, or experimental grid-scale projects pairing batteries and solar photovoltaic panels.

“In the last few months we’ve seen the frequency of these project announcements go up,” says Ravi Manghani, an energy storage analyst with GTM Research. Manghani adds that while there have been pioneering initiatives and pilot projects prior to now, it does appear that this solar plus storage technology is beginning to arrive.

Indeed, SolarCity — which is chaired by Tesla CEO Elon Musk — has just announced plans to bring precisely this combo to Hawaii, a state that continues to lead the way when it comes to the adoption of solar and batteries, thanks to its towering electricity costs, which are the highest in the nation.

SolarCity and the Kauaʻi Island Utility Cooperative jointly announced last week that they’ve entered into a solar power purchase agreement in which SolarCity will provide 20 years of power from a 52-megawatt-hour battery installation that will be able to send as many as 13 megawatts of electricity to the island’s grid. The battery will draw power from an accompanying solar array.

Meanwhile, out in California where much of the energy storage movement started, the California Energy Storage Alliance is pushing regulators for a cost-benefit analysis on storage+solar:

The significance in such a storage valuation scheme is that it helps utilities and regulators determine how much owners of such facilities should be paid for energy and services they offer the grid.

“The calculation of $0.25 as the value of solar-plus-storage means something like that could be justified as the amount customers who install solar-plus-storage should be reimbursed at,” explained Strategen Consulting Manager Edward Burgess.

This kind of a study and ultimate methodology could provide the basis for a steady and predictable flow of rate benefits for any customer who connects a battery to their solar PV array. With that rate of return, it becomes easy to finance battery purchases, leading to the kind of uptick in demand and decrease in costs that we’ve seen benefit the solar PV side of clean technology.

A lot of people are understandably wary about being early adopters of new technology. For the privilege, buyers often have to pay more and deal with unexpected problems. In the case of electric vehicles, the dynamic is the same, with many consumers worried about how long the batteries will last and what it will cost to replace them.

A lot of people are understandably wary about being early adopters of new technology. For the privilege, buyers often have to pay more and deal with unexpected problems. In the case of electric vehicles, the dynamic is the same, with many consumers worried about how long the batteries will last and what it will cost to replace them.

It’s hard to blame them. Reports from buyers of the first Nissan LEAF indicate that some batteries are failing pretty rapidly, sparking a class-action lawsuit. And some dealers of the Chevy Volt are quoting a whopping $34,000 for a full “drive motor battery replacement,” as Autoblog reports. Tesla, meanwhile, just unveiled a $29,000 replacement battery for their Roadster model, promising an additional 75 miles of range or so.

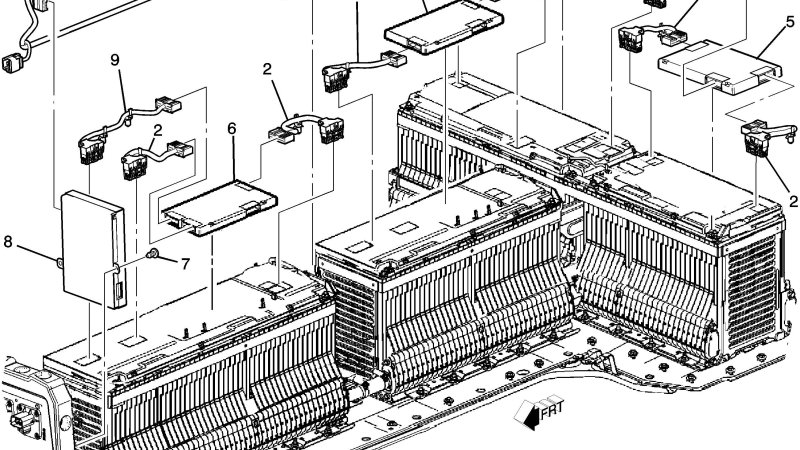

Autoblog performed a comprehensive look at what it might take to replace or repair a bad Chevy Volt battery, and the results are encouraging. For starters, after looking at the individual parts, the website found that while all three modules that make up the Volt battery add up to a fairly large $11,121.66 total, in most cases these battery cell modules do not need to be replaced:

There are many other individual pieces mounted on the battery pack that are serviceable, such as the Battery Energy Control Modules (BECM) and the Battery Interface Control Modules (BICM). These modules control and monitor the battery packs and charging system and have been known to fail while the lithium-ion battery cells are not at fault. Some have been replaced under warranty, but if you are stuck buying one they run about $255 a piece for the part. Getting a module replaced will cost you around $2,100 for parts, labor, and programming; labor can be a big hit since dropping the battery pack is required in order to service these modules.

If you are looking to replace the entire pack, the outlook has gotten better based on recent reports of refurbished battery packs becoming available for around $4,000. In these cases your entire battery pack is exchanged for one that comes from a refurbishing facility. These facilities do not produce any new parts but instead take packs that come in on exchange and combine the harvested pieces that are within spec from multiple packs to assemble refurbished packs.

Not bad prices if it buys you another 6-8 years of low-cost electric driving. The site includes a handy chart showing all the battery pack components:

Bottom line: fear of battery repair or replacement may not be such a big issue, particularly as we get more experience dealing with these used batteries coming out of the vehicles. Not to mention that there could and should be a robust market for buying these inexpensive used batteries, which would offer tremendous benefits for cleaning the grid and saving ratepayers money.

The intermittent nature of renewables like wind and solar require grid operators to balance these resources without increasing costs and pollution from fossil fuel-based power. There are three main ways to do this: the first is energy storage, to store surplus solar and wind energy for nighttime or windless days. The second is demand response, or flexiwatts, to moderate demand based on renewable availability.

The intermittent nature of renewables like wind and solar require grid operators to balance these resources without increasing costs and pollution from fossil fuel-based power. There are three main ways to do this: the first is energy storage, to store surplus solar and wind energy for nighttime or windless days. The second is demand response, or flexiwatts, to moderate demand based on renewable availability.

But the less-discussed third option for states like California is to harness renewables from across the west.

James Bushnell (Energy Institute at Haas) and Benjamin Hobbs (Johns Hopkins University) describe the benefits of California expanding its “energy imbalance market” to cover renewables in other states. While some fret that the expansion could create governance headaches and possibly open the door to California importing dirty out-of-state coal power, they knock down these arguments and also discuss the huge benefits of an export market for California’s renewables:

There are triple benefits to being able to more easily export this excess power. First, it will actually lower costs for Californians by improving the efficiency of those other plants. Second, it will lower costs for other states because they can reduce output from their conventional plants. Third, air pollution and greenhouse gas emissions will go down because California plants will operate more efficiently while plants elsewhere will operate less.

The state is overdue for integrating its grid into the west in this way, and it’s encouraging to see California’s grid operator take steps to launch the expanding market.

A report from the Australian Renewable Energy Agency this month indicates it’s likely:

The 130-page report prepared by AECOM predicts a “mega-shift” to energy storage adoption, driven by demand – from both the supply side, as networks work to adapt to increasing distributed and renewable energy capacity, and from consumers wishing to store their solar energy – and by the rapidly changing economic proposition; a proposition, the report says, that will see the costs of lithium-ion batteries fall by 60 per cent in less than five years, and by 40 per cent for flow batteries.

This projection is more bullish than most analyses I’ve seen, which suggest price declines of 8-10% a year. If true, the impact on both our energy and transportation system will be enormous. Cheap batteries paired with solar will lead to customer “grid defections” from utilities, plus a proliferation of microgrids that can run independent of the grid. And of course electric vehicles will become ubiquitous with the cheaper price and better range.

Another reminder that batteries are the most critical clean technology right now in the effort to decarbonize our economy.

Well, it was bound to happen. With California’s renewable industry taking hold and prices declining, the broader pushback had to begin sometime. Sure, utilities and some ratepayer groups have been decrying renewables for a while.

Well, it was bound to happen. With California’s renewable industry taking hold and prices declining, the broader pushback had to begin sometime. Sure, utilities and some ratepayer groups have been decrying renewables for a while.

But now we’re seeing a new attack from conservatives: renewables will cause “energy poverty” by driving up electricity prices.

Here’s Terry Jones in Investors Business Daily:

California’s policies are, by current engineering and scientific standards, insane. Under its current rules, 25% of the state’s electricity consumption will have to come from renewable sources by 2016. It won’t happen, but it’s the law. By 2020, 33% will have to come from renewable resources. And if Gov. Jerry Brown has his way, it’ll jump to 50% by 2030.

Of course utilities will not meet the standard. But they will try. And doing so, says Lesser, will make electricity more expensive. “When retail consumers subsidize electricity supplies at above-market costs, retail prices inevitably rise, even if the fuel is ‘free,’ ” Lesser wrote. They already have: Since 2004, residential electricity prices are up by more than 30%.

What’s insane is that Jones doesn’t know that California is on pace to well exceed the 33% target by 2020, given all the projects in the pipeline. It’s also insane that Jones doesn’t acknowledge the remarkable price declines in solar (10-20% just last year).

Jones may have a point, however, that rates may increase to reflect the cost of incorporating these new energy sources. It’s unclear by how much, but we should keep in mind two things: 1) low-income ratepayers already are eligible for heavily discounted electricity and other utilities, so they will not be affected, and 2) eligible residents, including the working poor, can get solar on their roofs with no-money down, thanks to the proliferation of solar leases. Those panels can offset rate increases.

And in the long run, what’s the alternative? Keep relying on large-scale, low-employment dirty power, which often pollutes most in the poorest neighborhoods? Or keep pushing on distributed, job-rich solar and wind resources that produce power cleanly and ever more cheaply?

What’s more, the end game here could have a major upside for California’s poor. In addition to the solar jobs that can’t be outsourced and the energy savings from going solar, even with a solar lease, decreasing solar and battery costs means more and more Californians will be able to un-tether from the grid completely. We’re not there yet, but at this rate we’ll be there in the next few decades.

And when that day arrives for everyone, energy will be cheap, clean, and providing major job opportunities for the state that helped make it happen with its forward-thinking policies.

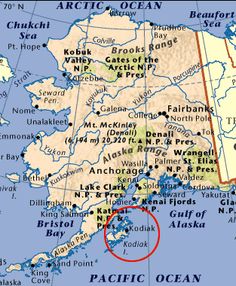

The Alaskan island, with plentiful hydro and wind resources, shows how it can be done:

The Alaskan island, with plentiful hydro and wind resources, shows how it can be done:

Previously overseeing an electrical grid almost entirely supplied by diesel generators, the board of the Kodiak Electric Association made the decision in 2009 to go renewable by 2020 as diesel prices continued to rise.

“We wanted to get off diesel,” association CEO Darren Scott said of the utility’s diesel generators, which used to provide expensive electricity to more than 6,000 residents of Kodiak, the village of Port Lions and the largest Coast Guard base in the country. “Diesel wasn’t going to be a part of our future.”

The switch to a grid run 99.7 percent on renewable resources not only stabilized Kodiak’s electric rates but also brought them closer to the national average. After Hawaii, where the average cost of electricity is nearly 34 cents per kilowatt hour, Alaskans pay the second-highest electric rates in the Untied States, at 17.58 cents. In Kodiak, customers are now paying 13.8 cents per kilowatt hour, just above the national average of 12.5.

The Alaska Renewable Energy Fund, established in 2008, helped fund the transition, which is expected to pay for itself in savings in under a decade. Meanwhile, cutting the diesel generators off reduced carbon dioxide emissions more than 60 percent each year.

Kodiak is setting a great example for other island states like Hawaii to follow. As the concept is proven in these island areas, they will be much easier and less costly to transport to mainland grids.

From a new study by the University of Wyoming:

From a new study by the University of Wyoming:

The wind in Wyoming tends to blow more during the winter and afternoon. California tends to be windier during the summer and at night, according to the report for the Wyoming Infrastructure Authority by Jonathan Naughton of the university’s Wind Energy Research Center.

That the wind doesn’t blow all the time and the sun doesn’t shine at night or on cloudy days are two of the biggest shortcomings of those renewable energy sources. But spreading renewable power out across the grid can make renewable energy generally more viable.

Chances are, if the wind isn’t blowing in one region, it’s gusty somewhere else.

The study compared wind patterns at California wind farms to those at sites with wind potential in Wyoming, including an approximately 1,000-turbine wind farm in south-central Wyoming that the Denver-based Anschutz Corp. plans to build to export electricity to California.

The Anschutz plant in particular will take years more to permit plus connect to transmission. But the study points to the need for better cooperation among western states to balance the plentiful renewable energy. California can’t do it alone, even with better demand response and energy storage technology. Ultimately, transmission and smart state policies will be key.

Per legislation passed in 2013, California’s investor-owned utilities finally had to disclose and map their energy system needs and information at the distribution level (i.e. areas served by wooden electric poles). The plans the utilities filed this month will greatly assist clean technology purveyors of all stripes:

Per legislation passed in 2013, California’s investor-owned utilities finally had to disclose and map their energy system needs and information at the distribution level (i.e. areas served by wooden electric poles). The plans the utilities filed this month will greatly assist clean technology purveyors of all stripes:

Mandated by state law AB 327, these DRPs are essentially blueprints for how Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric are going to merge rooftop solar, behind-the-meter energy storage, plug-in electric vehicles and other distributed energy resources (DERs) into their day-to-day grid operations and long-range distribution grid planning and investment regimes.

As more solar, energy storage, and electric vehicles come on-line, utilities will need both to plan for these resources and make it easier for clean technology companies to know where to place the resources for optimal value and ideally optimal revenue. While not perfect, the plans filed this month are an important step to a cleaner and more reliable grid.

Demand response, where electricity customers moderate their usage based on price and availability, is a critical strategy for balancing renewables on the grid (and for making the grid more efficient in general). Grid operators could start tapping into a powerful source, at least in California, Florida, and other warm states:

Through local intelligence — in the form of a chip on each device or a home computer for many devices — the collection of one million pools in Florida can be harnessed as massive batteries. Through one-way communication, each pool will receive a regulation signal from the grid operator. The pool will change state from on to off based on its own requirements, such as recent cleaning hours, along with the needs of the grid. Just as in the office building, each consumer will be assured of desired service.

Pools are, of course, just one example of a hungry but flexible load.

Of course, pools aren’t a great solution for droughts, but you get the idea. This option (demand response generally) is probably the cheapest and best bet for integrating variable renewables like solar and wind. It will still require infrastructure investment (note the microchips required on appliances) and better networking and rate design, but it’s doable and should be a priority. In the long run though, we’ll still need large-scale energy storage, whether it’s batteries or pumped hyrdo or some other technology.