The California State Senate Office of Research just released a new report examining data from the state’s transportation department, to find out how the California Environmental Quality Act (CEQA) affects transportation infrastructure projects.

As you’ll recall, CEQA mandates environmental review for major projects and feasible mitigation for significant impacts. Industry critics often blame CEQA for unnecessarily slowing vital projects.

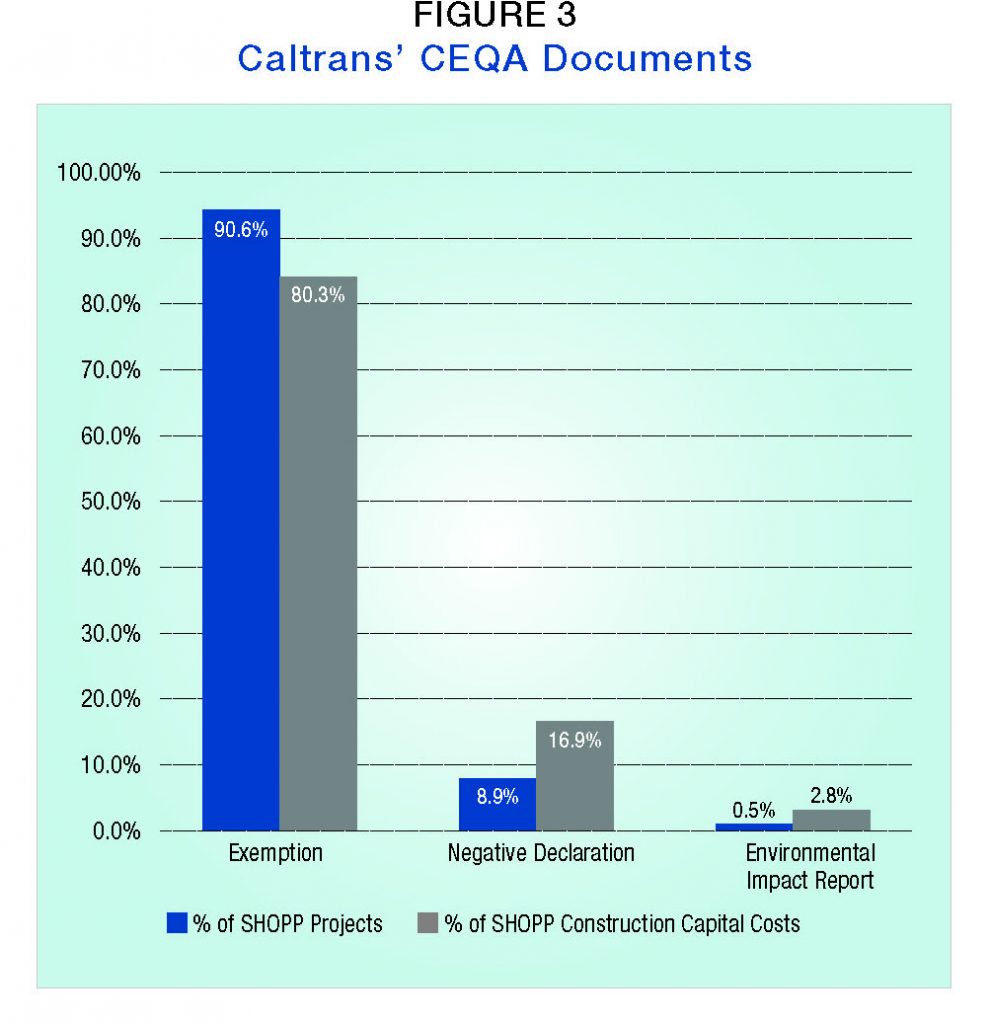

The results from the research? CEQA barely registers when it comes to rehabbing and maintaining transportation projects. As you can see from the chart below, between 80-90% of projects were exempt from CEQA altogether, while only between 0.5 and 2.8% had to undertake full environmental review. The rest received negative declarations of impacts.

The Office of Research obtained the data from Caltrans for 751 transportation projects from the State Highway Operation and Protection Program (SHOPP) program, which prioritizes everything from maintenance to rebuilding bridges. The projects all completed construction in fiscal years 2014 through 2017. The data included information on costs, duration, and the resulting CEQA documents.

The Office of Research obtained the data from Caltrans for 751 transportation projects from the State Highway Operation and Protection Program (SHOPP) program, which prioritizes everything from maintenance to rebuilding bridges. The projects all completed construction in fiscal years 2014 through 2017. The data included information on costs, duration, and the resulting CEQA documents.

Together with an earlier report showing how minimal CEQA litigation is when it comes to state-sponsored projects, plus the Rose Foundation report showing minimal litigation rates statewide, this report is further evidence that CEQA is simply not a major barrier to California’s transportation infrastructure investments.

To be sure, rehab and rebuilding projects are much less likely to face CEQA review issues than a new transportation project (such as high speed rail, which has been the target of substantial litigation). But data like these are helping to paint a clearer context for policy makers who hear anecdotes of CEQA abuse. Because when we start looking at the broader context, CEQA appears to impose relatively minimal costs in the aggregate.

Last week the California legislature did what many have been hoping for at the national level: pass an infrastructure bill. The issue was the state’s nearly $60 billion backlog in deferred maintenance for our transportation infrastructure.

Last week the California legislature did what many have been hoping for at the national level: pass an infrastructure bill. The issue was the state’s nearly $60 billion backlog in deferred maintenance for our transportation infrastructure.

But rather than deficit spend or raid other programs, the legislature took a politically brave step with SB 1 (Beall) of raising gas taxes and vehicle registration fees to pay for this work. It took a two-thirds super majority, which meant no room to spare on votes.

From an environmental perspective, the plan is good because it generally doesn’t pay for new capacity, just repairs and maintenance of existing infrastructure. The money will also help fund transit and bicycle and pedestrian infrastructure.

Environmentalists complained about a weakening of standards for truck drivers to retrofit or retire their dirtiest vehicles, but those impacts could potentially be blunted by tightening other environmental standards related to fuels and pollution limits. Some also objected to the new annual electric vehicle fee ($100) per year, which could discourage consumer adoption. But that fee seems relatively modest for vehicles that contribute to wear-and-tear on the roads.

The primary criticisms of the plan boiled down to the following:

1) California should spend its existing dollars more efficiently. Republicans and even one Democrat took this approach, arguing that “Caltrans reforms” could save us an equivalent amount of money. However, none of them to my knowledge spelled out exactly how much money could be saved and how from these reforms. I also don’t know of any study that has attempted to quantify potential savings. As a result, this criticism struck me as ideological posturing, along the lines that eliminating foreign aid and welfare could help balance the federal budget, when those programs are a mere pittance compared to military and insurance spending.

2) California should devote high speed rail money to deferred maintenance instead of funding this unpopular train project. Democratic state senator Steve Glazer made this argument, which is uninformed and inaccurate. High speed rail is funded by state bond money, approved by the voters, that cannot legally be diverted to other uses. Additional federal dollars are also reserved solely for train projects. Some cap-and-trade auction proceeds are directed to high speed rail and could theoretically go to other transportation uses, but these are only a few billion dollars at this point, hardly anywhere close to the $60 billion we need. Plus, those funds should go to projects that reduce greenhouse gas emissions, which high speed rail will do once it’s built and operational, whereas highway investments have the opposite impact.

3) California should find the money from existing transportation revenues that are instead spent on the general fund or other non-transportation sources. I’m admittedly less familiar with how transportation revenues are spent in the state, and in concept I would support efforts to ensure that dollars collected from transportation go to transportation improvements. But the critics, to my knowledge, presented no hard numbers on how much could be redirected to address the funding needs. So it was hard to take this criticism too seriously.

4) Californians already are overtaxed on transportation. Not when it comes to the gas tax and spending for road maintenance. The existing state and federal gas taxes have not kept up with inflation, and as vehicles become more fuel efficient, the revenues will continue to fail to keep up with usage. In short, most drivers are actually getting a cheap ride when it comes to paying for their fair share of road repair, minus the bills they have to pay to repair their cars from hitting potholes.

Overall, it’s an important spending bill that should help the environment to some extent, while also providing a fiscal stimulus in rural communities through the repair work. Higher gas taxes could also marginally dissuade people from buying gas guzzlers, although the taxes are relatively minimal compared to the price of gasoline.

But don’t expect this kind of action at the federal level, barring unlikely bipartisan cooperation with the Trump administration. Because raising taxes and fees isn’t popular, and it takes courage to do so when the need is great. And that kind of courage and foresight is in short supply at the federal level.

California’s transportation infrastructure has been steadily declining for years, a victim of neglect from dwindling gas tax revenue. As a result, local governments have been raising their own taxes to fund needed repair and expansion. But these efforts can undermine environmental goals by encouraging driving and more sprawl.

As the state’s just-released 2030 draft scoping plan for greenhouse gas reduction makes clear [PDF], reducing vehicles miles traveled (VMT) is essential to achieve sustainable growth and emissions in California:

While the majority of the GHG reductions from the transportation sector in this Discussion Draft will come from technologies and low carbon fuels, a reduction in the growth of VMT is also needed. VMT reductions are necessary to achieve the 2030 target and must be part of any strategy evaluated in this plan. Stronger SB 375 GHG reduction targets will enable the State to make significant progress towards this goal, but alone will not provide all of the VMT growth reductions that will be needed. There is a gap between what SB 375 can provide and what is needed to meet the State’s 2030 and 2050 goals. More needs to be done through continued land use changes, synergies with emerging mobility solutions like ridesourcing, and changes in travel behavior, especially among millennials.

Transportation investments can either encourage or reduce VMTs, if they go to automobile infrastructure instead of walking, biking and transit projects.

Now that Democrats have a super-majority in both houses of the legislature, they should prioritize new transportation spending in VMT-reducing investments. The best way would be to replace the gas tax with a mileage-based fee, with the revenue going only to maintenance of existing infrastructure and new VMT-reducing projects. The necessary two-thirds vote for that revenue is now possible, at least in theory.

In the long run, it could be the most important environmental legislation for the state to come out of this session of the legislature.

It’s a long overdue step. The U.S. federal government disproportionately funds automobile infrastructure without requiring any metrics related to key environmental impacts, namely carbon emissions.

It’s a long overdue step. The U.S. federal government disproportionately funds automobile infrastructure without requiring any metrics related to key environmental impacts, namely carbon emissions.

But new rules could change that. Per Streetsblog USA, the U.S. Department of Transportation unveiled a controversial proposal last week requiring state DOTs to track their performance:

Reformers hoped the rules would get states to reconsider highway expansion as a method of dealing with congestion and emissions, since widening roads induces more traffic and pollution. By introducing better metrics and reporting requirements, the thinking goes, U.S. DOT could compel states to document the failure of highway expansion, which would lead to pressure for a new approach.

Streetsblog is already critical of the rules, calling them “hugely disappointing.” They’d like them to go farther. Of course, road builders argue that the proposed rules are outside of the scope of statutory authority and are therefore invalid.

At this point, I think even weak rules are a major step forward, to establish the principle that these highway projects need some objective justification based on common-sense measures. In addition to carbon emissions, they should account for vehicle miles traveled, including induced travel, sprawl impacts (including induced sprawl), public health effects, and basic cost effectiveness.

In theory, the National Environmental Policy Act already requires this disclosures and analysis. But having these impacts tracked as conditions for funding under department guidelines really changes the ballgame. And weak initial rules can be tightened over time.

All in all, it’s a step in the right direction and hopefully the beginning of a sprint to clamp down on bad highway projects funded by our tax dollars.

As the California Legislature explores option to address the massive shortfall in funds for transportation infrastructure, a mileage-based fee appears to be off the table:

As the California Legislature explores option to address the massive shortfall in funds for transportation infrastructure, a mileage-based fee appears to be off the table:

Higher gas and diesel taxes, revenue from the state’s cap-and-trade program, and increased vehicle license and registration fees are among the possible sources of new revenue included in a transportation-funding package of principles put forward Monday by a coalition of local government, business and labor groups.

Notably missing from the list of possible ways to generate $60 billion over 10 years: A system of charging people based on the miles they drive instead of the fuel they pump. Such a system is the focus of a pilot study that received $10.7 million in the current budget. Assembly Speaker Toni Atkins, D-San Diego, mentioned the idea earlier this year as an option for generating more transportation revenue. And starting last month, thousands of Oregon motorists began testing mileage-based taxes.

But supporters of the fee, of which I’m one, need not despair. This will be a challenging program to implement, and it makes sense to start with the pilot and then build expertise and support from there in the coming years. Over the long run, California will have to adopt this policy. Otherwise, gas tax revenue will continue to decline with inflation and improved fuel economy, while voters will prefer transportation infrastructure that doesn’t collapse.

Drivers who join the program will be charged 1.5 cents per mile for trips that take place on Oregon roads. Participants will be given the option of using a GPS to record their miles or using a non-GPS option that will track usage based on the mileage counters of cars.

In return for participating, the drivers will be offered a tax credit reimbursing them for the 31-cent-per-gallon Oregon gas tax.

Participation in the program will initially be limited to 5,000 cars.

I imagine the first participants to sign up will be those in gas guzzlers who don’t drive very far. But in the long term, this is probably the best way to ensure we have adequate funds for our transportation infrastructure, particularly as vehicles become more fuel efficient.