AB405, SB146 and SB150 have officially been signed into law. Thanks #nvleg for your leadership & @TeslaMotors for hosting a great event. pic.twitter.com/t2L1DWNbnt

— Governor Sandoval (@GovSandoval) June 15, 2017

What a difference a year (or two) makes. Back in 2015, Nevada became the enemy of rooftop solar advocates when state regulators arbitrarily ended all rooftop solar incentives, including for customers who had already invested in them with an expectation of a 20-year return.

But Governor Sandoval just signed AB 405, which will officially restore those rooftop solar rates almost back to where they were, with a slow phase-out to encourage more energy storage options (see his Twitter post above).

But more legislation is on tap, as the legislature has passed some ambitious clean energy bills. Specifically, AB 206 will boost the state’s renewable energy portfolio standard to 40 percent by 2030 (by comparison, California has a 50% target for 2030). And as Greentech Media reports, the innovative part of this bill is that energy storage can count for up to 10% of the portfolio, with special privileges for geothermal energy. Let’s hope the governor signs this bill, too.

While the solar industry had a lot to do with this win, environmental groups may also have played a key electoral role. Specifically, according to E&E News (pay-walled), the League of Conservation Voters spent more than a half-million dollars on state races in Nevada last year and helped flip the statehouse, paving the way for legislation like this.

It shows how effective political dollars can be at the state level, and how important state leadership is at a time of federal retrenchment on clean energy policies.

Most electric utilities hate rooftop solar. When a customer installs solar on their roof, it means fewer sales (and therefore revenue) for the utility. It also means more unpredictable and dispersed sources of power from rooftops everywhere. As a result, many utilities across the country have been trying to kill state rooftop solar incentives for years.

I’ve covered the battles in states like California, Hawaii and Nevada on this blog. The short of it is that California has slightly decreased their incentives for rooftop solar, in the face of declining prices and concern about utility costs; Hawaii has retrenched significantly but in turn created a new market for home batteries + solar; and Nevada brutally ended their incentives a year ago, leaving even existing solar customers without incentives that they had relied on when they bought their panels.

I’ve covered the battles in states like California, Hawaii and Nevada on this blog. The short of it is that California has slightly decreased their incentives for rooftop solar, in the face of declining prices and concern about utility costs; Hawaii has retrenched significantly but in turn created a new market for home batteries + solar; and Nevada brutally ended their incentives a year ago, leaving even existing solar customers without incentives that they had relied on when they bought their panels.

But the end of 2016 brought some significant updates for Nevada and now a new state, Arizona. First, as Greentech Media reported, Nevada regulators have restored the incentives for customers in the northern utility service territory (after having previously given into public pressure and restored the incentives for existing customers to “grandfather” them in).

But Arizona regulators have decided to jump off the rooftop solar cliff, killing existing incentives (which involve a full retail credit for every surplus kilowatt of electricity generated by the panels and not used on-site). Instead, solar customers in Arizona will be eligible for a vastly reduced and unpredictable “export rate” for any surplus electricity generated. As the Arizona Daily Star described:

The export rates will be determined in each utility rate case and will initially be based on a “resource comparison proxy” based on a weighted, five-year average cost of power from utility-scale solar farms.

The new export rates will vary by utility and be stepped down annually, in increments limited to 10 percent each year.

Solar industry advocates are already predicting that their industry will die in Arizona, as they correctly predicted would happen in Nevada after incentives were killed there, too.

Once those jobs disappear and Arizonans realize what they’ve lost, especially given that the state was otherwise one of the best-selling markets for solar with its abundant sunshine and high air conditioning bills, expect major political pushback. I wouldn’t be surprised if we see a Nevada-like reversal in the coming year or so.

In the meantime, the big winner could be battery companies like Tesla. Per Bloomberg, as the company “flipped the switch” yesterday on its gigafactory in Nevada, it will potentially have a new market to sell its product.

Why? Because if solar customers in Arizona aren’t going to get paid much for their surplus energy anymore, they’ll be interested in a cheap battery that can store that surplus and help them use all of it on-site. The battery therefore allows them to effectively recreate that full retail credit they used to get under the old system: any electricity they would have had to purchase from the utility when the panels weren’t producing or producing enough, they can now get from their battery.

So while states lurch around on their rooftop solar policies, the long-term trend seems clear: the incentives are decreasing, and cheaper batteries will be filling that void.

Hawaii and Nevada represent two states pioneering a “post-net metering” world for rooftop solar. Collectively, they’re providing some interesting learning experiences for the rest of the country.

Many other states have traditional net metering, in which any surplus rooftop solar energy you produce for the grid is credited at a full retail rate on your bill. But Hawaii and Nevada utilities have successfully pushed back on that approach, convincing state regulators to diminish or even gut the incentives.

First, Hawaii: the state has significant rooftop solar uptake, with a nation-leading 17% of all customers in the main utility’s service territory. But the utility there has been trying to fight further proliferation with the usual arguments related to reliability and cost.

First, Hawaii: the state has significant rooftop solar uptake, with a nation-leading 17% of all customers in the main utility’s service territory. But the utility there has been trying to fight further proliferation with the usual arguments related to reliability and cost.

The state’s regulator has largely followed the utility line, ending net metering and replacing it with two options. The first is a fixed rate payment for surplus power that is less than the full retail credit, called a “grid supply” option. The second is a “self-supply” option that features a minimum bill and only some surplus power allowed back on the grid.

Perhaps not surprisingly, the fixed rate “grid supply” option has been the most popular. But regulators imposed a cap on that program, which the islands have already started to bump up against. As a result, solar companies are lobbying hard for regulators to raise the cap. But even if they raise the cap, the long-term problem isn’t going away.

So that’s why it’s interesting to see the market in Hawaii respond with technology packages to help spur demand for the self-supply option. As Utility Dive reports:

Other solar developers like Sunrun and SolarCity have rolled out offerings aimed at the CSS [self-supply] option. SolarCity’s product is a combination of storage, solar systems and a Nest thermostat, water heater and controller, allowing consumers to use more of their energy onsite.

The savings are significant, according to Mark Dyson from Rocky Mountain Institute. By using the product, customers could “save 33% on their electricity bill, “which amounts to “nearly 80% of the savings that the old NEM arrangement offered.”

Sunrun’s Brightbox is another option. The company teamed up with Tesla to offer solar-plus-storage system, a much simpler one than SolarCity. While the first Brightbox installation occurred earlier this year, the company plans to roll out this offering in full force before the end of the year.

Both offerings could receive a boost if a group of energy storage bills reappear in the next legislative session, bringing down the cost of storage installation through extending tax credits, offering rebates or both.

So in Hawaii, we may end up seeing a combination of smart new policies and technology and financing packages that can make a post net-metering world viable there for distributed clean technology.

Nevada, meanwhile, is pulling back from the brink a bit. The state’s electricity regulators had previously yanked all solar incentives — not just for new customers but for existing ones that already plopped down thousands of dollars (in some cases) for rooftop PV.

But now a deal seems to have been worked out to soften the harsh retrenchment. Per the Reno Gazette-Journal:

NV Energy reached an agreement with the Public Utilities Commission of Nevada, Bureau of Consumer Protection and SolarCity to grandfather eligible customers under previous rates for residential rooftop solar that featured lower fees and higher reimbursement rates for the energy produced. The rates were hiked in December and also retroactively applied to existing customers.

“NV Energy’s intent with its grandfathering proposal was to offer a solution for customers who installed or had valid applications to install rooftop solar systems … in the most efficient and timely manner,” the company said in a statement. “We appreciate all parties coming together to expedite the process on behalf of our customers.”

The grandfathering agreement will apply to about 32,000 customers, including those who had a pending application on Dec. 31, 2015. Customers who withdrew a valid application or had their application for the RenewableGenerations expire between Dec. 21 and Dec. 31 are eligible to be grandfathered as well. The agreement still must be approved by the PUC, which is expected to vote on it on this week.

It’s a welcome development for those existing customers, who were treated unfairly by the abrupt policy change. But more will be needed to rescue the state’s rooftop solar industry, which has been annihilated by the new policy. Perhaps Nevada may need to consider a policy more like Hawaii’s grid-supply option as a compromise. But in the meantime, a ballot measure backed by the solar industry could reinstate solar incentives, if voters approve.

All in all, both states provide glimpses of a possible future for state rooftop solar incentives. While some experimentation is happening there, at least in Hawaii, it’s clear that they both need to improve their policies to keep rooftop solar — and the environmental benefits that flow from it — alive and well.

Nevada and Hawaii are two states that have taken different, though both scaled-back, approaches to rooftop solar. But the good news for solar advocates is that both states appear to be making progress, for different reasons.

First, Hawaii. The Aloha State retrenched from the generous net metering retail rate compensation last year. Instead, state regulators pushed a hybrid option that allows customers to either take a wholesale rate for all power they export or get a retail credit for all the power they use on-site (but not for any exports, which are not credited).

First, Hawaii. The Aloha State retrenched from the generous net metering retail rate compensation last year. Instead, state regulators pushed a hybrid option that allows customers to either take a wholesale rate for all power they export or get a retail credit for all the power they use on-site (but not for any exports, which are not credited).

And in a positive development, the new rates are actually leading to enough customer demand that the state may soon reach its cap on new enrollees. As Utility Dive reports, the cap may be met as soon as next month. What that means is that the economics of the reduced incentives are still working for many customers, and it also gives them an incentive to buy a battery, if they go with the retail rate (in order to maximize their on-site usage).

Granted, Hawaii uniquely has ridiculously high electricity rates and tremendous solar exposure, making it not exactly representative. Still, it shows that the economics of reduced incentives can still work, once the price of the panels comes down (or the price of electricity increases).

Meanwhile, over in Nevada, the state gutted its solar incentives, even going back on its deal with existing customers, leading to stranded assets and betrayed buyers. But now an electoral push may reverse this decision by voter initiative. The utility is fighting back, per the Las Vegas Review-Journal, but so are solar companies. And there are murmurs that the governor is willing to hash out a deal with the solar companies.

Meanwhile, over in Nevada, the state gutted its solar incentives, even going back on its deal with existing customers, leading to stranded assets and betrayed buyers. But now an electoral push may reverse this decision by voter initiative. The utility is fighting back, per the Las Vegas Review-Journal, but so are solar companies. And there are murmurs that the governor is willing to hash out a deal with the solar companies.

My guess is that Nevada will end up with a compromise, perhaps along the lines of the Hawaii path. And in the long run, we know the current generous net metering incentives won’t last forever. So a future that still encourages deployment and also on-site storage in the form of batteries would be a good one.

In the very long term, rooftop generation may not be the best way forward anyway, particularly given that many people don’t have a rooftop with sun exposure or lack sole access to theirs. So we should be simultaneously encouraging more community solar and microgrids as the best way to decarbonize and localize our electricity systems, leading to greater reliability and cheaper prices in the process.

From a clean tech perspective, Nevada’s been getting lots of bad press recently for killing its rooftop solar industry. But a recent announcement and ceremony on EV charging puts them in a better light, at least on electric vehicles (of course, by killing rooftop solar, the state is making it less likely people will want to buy EVs).

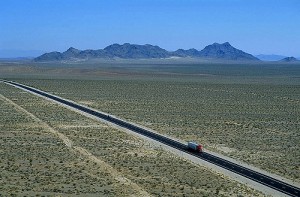

Highway 95 between Las Vegas and Reno connects Nevada’s two biggest cities. I’ve done the drive twice, including last summer, and I think it’s one of the most beautiful, desolate roads in the country. It’s also super dangerous — I saw accidents each time I drove it, due to the two-lane configuration, blurry rural vistas, lots of cars, and lots of passing that narrowly misses oncoming traffic.

Highway 95 between Las Vegas and Reno connects Nevada’s two biggest cities. I’ve done the drive twice, including last summer, and I think it’s one of the most beautiful, desolate roads in the country. It’s also super dangerous — I saw accidents each time I drove it, due to the two-lane configuration, blurry rural vistas, lots of cars, and lots of passing that narrowly misses oncoming traffic.

But it’s nice to see that soon EV drivers can make that trip without stress (at least related to running out of juice):

About 40 people — a mix of Valley Electric Association board members and executives, residents of the small town that is the gateway to Death Valley National Park, employees of Eddie World, an iconic stopover on the seven-hour trip between Las Vegas and Reno, and curious travelers on U.S. Highway 95 — gathered to watch Sandoval and others cut a ribbon marking the official opening of the charging stations.

There are two charging stations at the site with three ports each. Two of the ports have connections that will fully charge a vehicle in four hours, but one of them has a fast charge that can take a vehicle to 80 percent charged within 30 minutes.

“It was just great looking out in the crowd and seeing all the happy faces of the people of Beatty because they know that they will always know they were the first to have this,” Sandoval said after the 20 minutes of remarks by several dignitaries.

The opening of the Beatty charging station is the first of four planned along U.S. 95, the 448-mile primary route between the state’s two most populous cities, Las Vegas and Reno.

Other stations are planned in Tonopah, Hawthorne and Fallon. Sandoval said he plans to celebrate them all.

What’s crazy is that California has not done the same level of planning and infrastructure investment for its key highways. That includes both Highway 99 in the eastern Central Valley and Interstate 5 connecting L.A. to the Bay Area and Sacramento, not to mention Interstate 101.

At least on EVs, California has something to learn from Nevada.

It seems ironic, but the big win to extend the renewable energy tax credit in the federal budget deal last year may make state solar rooftop incentives more controversial. Or so suggests Greentech Media:

It seems ironic, but the big win to extend the renewable energy tax credit in the federal budget deal last year may make state solar rooftop incentives more controversial. Or so suggests Greentech Media:

Many states were reviewing their net energy metering policies and programs while awaiting the ITC decision.

“The solar industry has gotten its holiday wish list,” Zach Pollock, also in PA Consulting’s energy and utilities practice, said of the ITC extension. “What that has done is put additional pressure on the state policies.”

For states with vertically integrated utilities that have been avoiding the policy considerations related to potentially robust third-party solar markets, “It’s going to be more about blocking and tackling,” said Mooren.

Nevada is the perfect example of the controversy, where the rollback of rooftop solar incentives, even for existing customers, has sparked a clean tech backlash and lawsuit, despite electric vehicle companies Tesla and Faraday locating in the state. And in California, which went the other way recently, opponents of rooftop solar incentives noted that the federal tax credit means states don’t have to keep subsidizing rooftop solar to the same extent.

Meanwhile, one industry may benefit from the net metering rollback: energy storage. Some analysts think Nevada’s new rules could push existing solar customers to buy on-site energy storage, like home batteries. That way customers could capture surplus solar power they produce and use it when the sun goes away. It would be a way to salvage their investment: otherwise the utility would no longer compensate them for the surplus, so it would be wasted.

In the long run, net metering incentives will have to ramp down, but the industry isn’t quite there yet. That’s why it’s important for solar advocates to keep the fight going state-by-state.

California regulators looked into the solar abyss that is now Nevada and said “no thanks” yesterday.

California regulators looked into the solar abyss that is now Nevada and said “no thanks” yesterday.

In a narrow 3-2 vote, the Public Utilities Commission decided yesterday to keep current rooftop solar incentives basically as they are, with relatively minor tweaks.

Like many states, including Nevada, California has been grappling with how to reform its net metering program, which is the critical incentive for homeowners to go solar. Under net metering, customers get retail credit for any surplus solar energy they produce on-site but don’t consume.

Nevada, on the other hand, in a stunning display of holiday Grinch-ness this past December, killed the incentive, even for customers who had already bought the panels expecting 20-year returns (Nevada regulators are now revisiting the order for these customers). The move effectively killed the in-state solar industry, which pulled out en masse.

California regulators could have done the same, as utilities were itching to kill rooftop solar, at least of the solar lease variety. By imposing high monthly fees, utilities would be able to erase the savings margin on many systems.

But yesterday’s decision [PDF] puts the issue to bed in California until 2019. Utilities did secure a one-time interconnection fee for new solar customers, as well as a minimum monthly charge. But they didn’t secure their bigger objective to raise rates significantly on solar customers.

In the long run, these incentives will need to ratchet down. Costs are decreasing on solar panels, and higher penetration will bring new costs associated with integrating the intermittent power. But by staying the course, California regulators send a strong message that the industry needs continued support, and California is committed to providing it.

And as a potential postscript, Nevada voters may soon have the opportunity to overturn their regulators’ move, if a backlash measure qualifies for the ballot this year. That will be a fun story to follow.

Right before Christmas, Nevada regulators pulled the plug on rooftop solar incentives. Brutally, the move didn’t just undercut payments for utility customers with solar going forward, it retroactively reversed the deal on those who already invested thousands of dollars in panels:

Right before Christmas, Nevada regulators pulled the plug on rooftop solar incentives. Brutally, the move didn’t just undercut payments for utility customers with solar going forward, it retroactively reversed the deal on those who already invested thousands of dollars in panels:

“I feel cheated and robbed,” said Dale Matz, a retired chef who invested $30,000 in solar panels. He made the switch to solar both as a retirement decision and to help combat climate change.

Matz and Stewart are organizing a rally outside a PUC hearing on Wednesday. They hope that a demonstration with hundreds of disgruntled solar enthusiasts will inspire lawmakers to challenge the rule change.

The basic change is a new monthly fee of $40 for solar customers, completely gutting their monthly savings from panel leasing. Meanwhile, the payment for surplus energy that homeowners export to the grid will go from full retail value down to just one-third of that price.

The result is the total collapse of Nevada’s solar industry, with SolarCity laying off 550 people in the state. Plus the duped solar buyers.

Their best hope is probably a new legislature and governor who would be willing to overrule the regulatory decision. But that’s not likely to happen anytime soon. Overall, it’s a cautionary tale for solar homeowners in purple states, and a glimpse of what could have happened in California had utilities had their way.