If you follow the press releases of some traditional automakers these days, you might think they are fully committed to an all-electric vehicle future. Since the election of President Biden, companies like General Motors and Ford for example have pledged billions toward electrifying their entire lineup of vehicles.

Yet sales data, company behavior, and policy advocacy reveal a different story. They show a legacy auto industry struggling to compete in a future of all-electric vehicles, with EV products that are falling behind industry-leader Tesla and a generally weak commitment to the needed policies and infrastructure investment.

First, look at the sales data. Legacy automakers badly trail Tesla, both in California and nationwide. As a snapshot in California during the first quarter of 2021, as compiled from state agency data by the nonprofit Veloz, Tesla’s Model Y (see photo below) was the top-selling electric vehicle model in the state at 15,265 units sold, with the Model 3 second at 14,536. Next up is the Chevrolet Bolt EV, a vehicle that has remained virtually unimproved since its debut four years ago (though slated to get a minor upgrade this year), at a distant third with 5,252 units sold. The plug-in hybrid (not a true all-electric model) Toyota Prius Prime was fourth at 4,081 sales.

Nationwide, the sales gap is just as stark, according to Car and Driver. The Model Y was again the number one selling EV at 33,629 units in first quarter 2021, more than all other non-Tesla EVs combined. Next was Tesla’s Model 3 at 23,110 units. The Chevy Bolt came in a distant third again at 9,025 units, with the newcomer Ford Mustang Mach-E fourth at 6,614 units sold. Next was Tesla’s Model X at 5,106 (potentially seeing a demand pause ahead of an anticipated update), Audi e-tron and e-tron Sportback at 4,324, and then the Tesla Model S at 4,155 (also ahead of an update and range boost). Notably, the once market-leading EV Nissan Leaf, which like the Bolt has seen little improvement in the decade since it was introduced, clocked in at just 2,925 units sold.

Why are legacy automakers so far behind Tesla in this crucial new technology? Unfortunately, their products and technology are not keeping up with Tesla, though they do tend to have superior reliability and build quality. Most of the traditional automakers’ EV products have shorter range on a single charge, slower charging, and more limited access to EV charging stations. And yet some of these vehicles are actually priced higher than lower-priced Tesla’s, with the companies relying instead on continued access to federal EV tax credits, which have reached their limit for Tesla buyers.

By contrast, Tesla’s leadership had the vision and commitment early on to develop electric vehicle products that consumers want, while investing aggressively in electric vehicle infrastructure and battery and charging technology innovation. For example, Tesla paid for their high-powered Supercharger stations as loss leaders to help sell the vehicles, recognizing that concern over limited access to public charging was a major issue for potential customers. And these Supercharger stations can typically charge the vehicles at a much faster rate than what most non-Tesla EVs can handle.

Despite the press releases on EVs, legacy automakers continue to invest heavily in manufacturing and selling large gas-guzzling SUVs. As General Motors CEO Mary Barra commented recently via Reuters:

Barra added the No. 1 U.S. automaker was focused on maximizing production of high-demand vehicles like the full-sized Chevrolet Silverado pickup, and GMC Yukon, Chevy Suburban and Cadillac Escalade SUVs.

Those polluting trucks and SUVs are a far cry from the all-electric, clean future Barra promises to other audiences. And on infrastructure, these automakers have largely refused to help pay for the charging stations needed to compete in this new field to sell their vehicles, instead relying on third parties and public subsidies.

The companies’ behavior on policy similarly mirrors this weak commitment to EVs. Most if not all traditional automakers have resisted zero emission vehicles policies from the get-go, including fighting California’s landmark zero-emission vehicle mandate from its inception in the 1990s. Up until the most recent presidential election, companies like General Motors and Toyota were eager to side with Trump Administration’s attempted rollbacks of national clean vehicle policy (though notably Ford, Honda, Volkswagen and BMW sided with California). That rollback (now stopped by Biden) would have been a significant setback to the pace of vehicle electrification and climate policy in this country.

But is it all doom and gloom for these companies? Yes and no. Some may now be so far behind on electrification that they might eventually go the way of Kodak and Radio Shack, as hard as it may be to believe now. Others are rapidly trying to pivot and adapt. For example, Volkswagen, after getting caught cheating on its vehicle emissions data, has now been forced to develop new EV product lines, and its new ID 4 crossover vehicle may hold some promise. Other new models, including electric trucks, may also soon prove popular.

But it’s difficult to imagine where the U.S. and the broader electric vehicle industry would be on transportation electrification without Tesla. If not for Tesla, EV sales would be paltry. Legacy companies would likely continue to build the bare-minimum “compliance” cars needed to meet California’s zero-emission vehicle mandate. Automakers would probably still be complaining that EVs are unrealistic, infeasible and not want consumers want. As a result, it would be impossible to meet long-term climate goals, given how much the transportation sector contributes to greenhouse gas emissions.

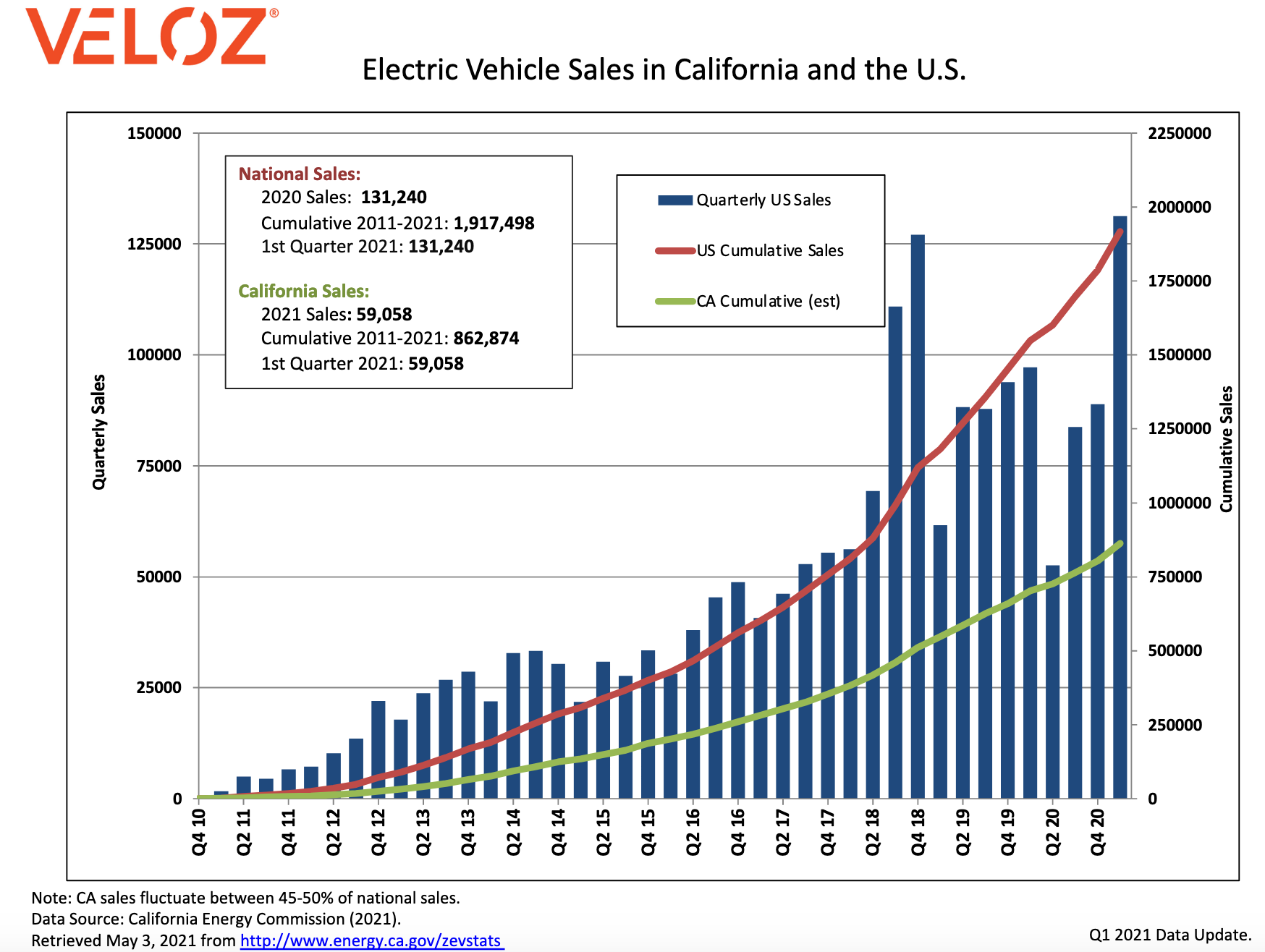

Fortunately, we’re in a better place now with electric vehicles. Plug-in electric vehicles constituted 9 percent of new car sales in California, the largest EV market in the U.S., with approximately half of nationwide sales (see chart below). It’s decent progress toward a statewide goal of 100% zero-emission vehicles sales by 2035. By comparison, 20% of new car sales in China’s major cities are plug-in vehicles, as Bloomberg reported, with the European Union as a whole at 6.7% market share in 2020, projected to rise to 8.5% this year, per Forbes.

Thanks to this progress, EVs have now broken into the mainstream, providing the credibility to underpin Biden’s new infrastructure plan for boosting them, which includes significant new subsidies and incentives for electric vehicles and charging infrastructure.

But we’ll need many companies to get in on vehicle electrification, including the legacy automakers, both to provide sufficient products for the market and also ensure competition to keep prices low and encourage innovation. At this rate, it’s an open question whether traditional automakers can rebound for the long haul, or if the automakers of the future will instead come from new EV players that follow in Tesla’s footsteps.

Because while the electrification of vehicles is inevitable, the future of the auto industry is decidedly not.