Over at the California Public Utilities Commission (CPUC), regulators are having a tough time fending off utility efforts to severely curtail rooftop solar. Legislation passed in 2013 requires the CPUC to engage in a new rate-making process, which has already resulted in rates that eliminate the expensive top tiers that encouraged high-consuming ratepayers to go solar.

Over at the California Public Utilities Commission (CPUC), regulators are having a tough time fending off utility efforts to severely curtail rooftop solar. Legislation passed in 2013 requires the CPUC to engage in a new rate-making process, which has already resulted in rates that eliminate the expensive top tiers that encouraged high-consuming ratepayers to go solar.

But now, according to Greentech Media, new utility proposals promise to limit customer incentives to go solar even more:

PG&E and SCE…want to pay [solar] net-metered customers quite a bit less for the power they feed back to the grid, by paying a rate based on the cost of generating power. That’s similar to a proposal floated by Hawaiian Electric earlier this year.

But these reduced rates don’t take into account the value that net-metered solar provides, [Sunun’s Robert] Harris said. That could come from reduced transmission and distribution grid costs, or replacing the power that would otherwise need to come from new natural-gas-fired power plants.

PG&E noted that a typical solar customer would see a relatively small reduction in monthly bill savings, from 60 percent under today’s rules to about 50 percent under its proposal. But for companies like SolarCity and Sunrun, small reductions multiplied across tens of thousands of customers can add up to big financial impacts.

Even more problematic are the new charges the utilities want to impose on net-metered customers, Harris said. Specifically, PG&E has proposed a $3 per kilowatt-per-month demand charge, based on the one moment during each month that a customer’s energy use reaches its highest peak, while SCE has proposed a $3 per kilowatt-per-month “grid access charge” based on the size of the solar system being connected to the grid.

Severin Borenstein at UC Berkeley’s Energy Institute puts in all into perspective:

Economists have for years argued that utility rate design should follow cost causation principles, because departures from cost will lead to inefficient customer response. Regulators have often paid little heed largely because the inefficiency was small when customer ability to respond was limited. That left regulators a free hand to harness rates for pursuit of other policy agendas.

Distributed generation, storage, electric vehicle charging, and smart customer-side usage technologies (think controllable communicating thermostats) mean that the inefficiencies from sloppy rate design – prices that depart substantially from cost – will be magnified.

But the flip side is that the opportunity to incent efficient customer-side participation in the market with smart rate design is greater than ever. And that opportunity will grow exponentially in the next few years as we see continued improvement in generation technologies, batteries, and sensors that can control a panoply of household activities. Accurate cost-based pricing can not only lower costs, but can also use customer-side participation to gain the flexibility that will be required to integrate more wind and solar power.

If we follow Borenstein’s logic, what the CPUC should really do is set flexible, dynamic rates that reflect that actual cost of providing electricity, and then communicate those price changes to ratepayers instantly, particularly via wired, networked appliances that can adjust demand based on price.

And if the cost figures take into account impacts like pollution from fossil fuel-based power, that could provide a big boost to clean technologies, while protecting ratepayers from inefficient rates.

Per legislation passed in 2013, California’s investor-owned utilities finally had to disclose and map their energy system needs and information at the distribution level (i.e. areas served by wooden electric poles). The plans the utilities filed this month will greatly assist clean technology purveyors of all stripes:

Per legislation passed in 2013, California’s investor-owned utilities finally had to disclose and map their energy system needs and information at the distribution level (i.e. areas served by wooden electric poles). The plans the utilities filed this month will greatly assist clean technology purveyors of all stripes:

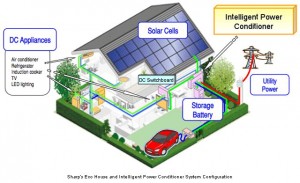

Mandated by state law AB 327, these DRPs are essentially blueprints for how Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric are going to merge rooftop solar, behind-the-meter energy storage, plug-in electric vehicles and other distributed energy resources (DERs) into their day-to-day grid operations and long-range distribution grid planning and investment regimes.

As more solar, energy storage, and electric vehicles come on-line, utilities will need both to plan for these resources and make it easier for clean technology companies to know where to place the resources for optimal value and ideally optimal revenue. While not perfect, the plans filed this month are an important step to a cleaner and more reliable grid.