With Republicans in control of the federal government, climate advocates have looked to the states to make progress reducing greenhouse gas emissions. From my perspective, this is a positive and much-needed approach to climate action, given how relatively weak federal efforts on climate have been, even when Obama as president.

With Republicans in control of the federal government, climate advocates have looked to the states to make progress reducing greenhouse gas emissions. From my perspective, this is a positive and much-needed approach to climate action, given how relatively weak federal efforts on climate have been, even when Obama as president.

Progressive states can move much more aggressively and help pioneer policies and programs that can then become a model for the U.S. as a whole. And in the meantime, they can help bring down the costs of clean technologies like solar and electric vehicles, just through their market power. We’ve seen this play out in California.

But ClimateWire reported [pay-walled] that many of these state policy efforts are languishing, particularly the push to implement carbon pricing (through a carbon tax or cap-and-trade program):

Environmentalists have little hope of passing a proposed $35-per-ton carbon tax in New York, where Republicans control the state Senate. Connecticut and Rhode Island both have proposed enacting a $15-per-ton carbon tax, but only after Massachusetts acts. Massachusetts and Vermont both have Republican governors who acknowledge climate change, but are cool to the idea of a carbon tax.

Even in Oregon and Washington, states where the prospects for a carbon price may be best, climate hawks face long odds. Short legislative sessions and entrenched opposition to a cap-and-trade program in Oregon and carbon tax in Washington complicate the outlook for both proposals.

My question is: why are climate advocates focusing on carbon pricing in the first place? Nobody really likes tax increases, and the fight over what to do with the revenue seems to be dividing people. And in the bigger picture, a price on carbon may be less important at this stage of the climate fight than just getting these clean technologies to scale. After all, once renewable energy, zero emission vehicles, and other needed technologies are cheap, a carbon price should be much easier to implement, politically speaking.

I would prefer the focus at the state level be on setting strong greenhouse gas emission reduction targets through law, empowering key state agencies to achieve the targets (as happened in California), and boosting policies that help deploy clean technologies, such as electric vehicle incentives, aggressive renewable energy and energy storage mandates, and energy efficiency standards for new and existing buildings.

Once progress is made on these fronts, these states will have built up clean tech industries and the resulting political will needed to price the dirtier alternatives.

The Trump Administration’s new tariffs on foreign solar panels were met with cries of doom and gloom from some in the industry. But so far, the signs from the market may indicate that industry can weather the storm, albeit without the hoped-for gains in U.S jobs.

The Trump Administration’s new tariffs on foreign solar panels were met with cries of doom and gloom from some in the industry. But so far, the signs from the market may indicate that industry can weather the storm, albeit without the hoped-for gains in U.S jobs.

Two reasons stand out: first, the tariffs themselves are time-limited. As a result, foreign companies may be reluctant to make a long-term investment in moving their facilities to the U.S. for only a temporary gain, as E&E news reports [pay-walled]:

The tariffs, which begin at 30 percent in the first year and decline 5 percent each of the next three years, weren’t as extreme as the solar industry envisioned in terms of rate and length. That’s calmed fears for the broader domestic industry, though installations are still expected to fall.

But that also likely squashed the Trump administration’s goal of boosting domestic production — considered a long shot in any case by the broader solar industry — through a tariff and tariff-free quota for cell imports. That’s partly because companies might be willing to absorb the cost of tariffs in the short term rather than make more expensive, longer-term investments in the United States, which opponents of the tariffs argued was always the case.

Second, solar panel manufacturing appears at this point to be almost entirely automated, meaning few jobs are actually at stake. Take First Solar, a U.S. manufacturer that recently renovated its Ohio plant as an almost fully automated operation. As Bloomberg News reports:

Today a visitor to the factory, which reopened in December, looks out over a line of robotic arms guiding sheets of specialized conductive glass onto rollers that snake 3 miles through cleaning, grinding, and spraying machines. A final robot grabs the completed panel, about the size of a large flatscreen TV, and places it in a box for shipment. There are just a few dozen workers scattered about; before the renovation, there were hundreds. The company acknowledges that it’s cut jobs, but it says the ones that remain are safer and pay better.

As a result of the automated nature of solar manufacturing, it may be relatively cheap for those foreign companies who do wish to set up a plant in the U.S. to do so, albeit without any significant domestic job gains. For example, JinkoSolar just announced that it plans to invest more than $400 million in a manufacturing plant in Jacksonville, Florida by the end of 2019, apparently in response to the 30 percent tariffs, per the Wall Street Journal. If the company was planning to expand anyway and can save on shipping costs, this investment may be relatively minimal for them, compared to the alternative.

Meanwhile, to the extent that solar installers are hurt by this tariff, it seems clear that beneficiary will be natural gas. Bloomberg quoted SolarReserve Chief Executive Officer Kevin Smith along these lines:

“Solar energy’s main competition is natural gas and that’s where I think we’ll see some changes on the margins,” Smith said. “We’re going to see a shift to a little less solar and a little bit more gas sales.”

In the long term, increasing the price of solar by the 8-10% that some analysts predict from these tariffs only brings the price of solar PV back to where it was in 2016. And with further price declines due to industry innovation, plus the phasing out of these tariffs, the solar industry should weather this storm and emerge stronger after a few years. And in the meantime, the Trump Administration will likely have failed to slow the foreign advantage on solar panels or create the hoped-for domestic manufacturing job boost.

Following up on a campaign promise to crack down on free trade policies, the Trump Administration yesterday announced that they will be imposing tariffs on foreign solar photovoltaic (PV) panels. The tariffs will start at 30 percent in the first year and then decline to 25 percent in year 2, 20 percent in year 3, and 15 percent in year 4.

Following up on a campaign promise to crack down on free trade policies, the Trump Administration yesterday announced that they will be imposing tariffs on foreign solar photovoltaic (PV) panels. The tariffs will start at 30 percent in the first year and then decline to 25 percent in year 2, 20 percent in year 3, and 15 percent in year 4.

The move was largely expected. The case originated in May 2017 when two now-bankrupt U.S. solar companies filed for temporary relief from competition from cheaper foreign solar panels, under Section 201 of the 1974 U.S. Trade Act. The law gives the executive branch wide authority as a “global safeguard” to provide temporary relief when foreign imports are causing “serious injury” to a U.S. industry.

In this case, Suniva and SolarWorld, the two failed companies (ironically mostly owned by foreign entities) petitioned the U.S. International Trade Commission (ITC) to investigate whether foreign imports were causing them serious injury and recommend remedies. The ITC last October found for the companies and recommended tariffs as high as 35%.

Under the law, the president then has wide authority to implement tariffs once the ITC has made a finding of injury. In this case, the administration actually did not impose as high a tariff as they could have, given the ITC recommendation up to 35%. But nonetheless, the solar industry was predictably opposed to such tariffs and claim that 23,000 job losses will result in the solar industry, along with a big slowdown in domestic solar PV deployment.

There’s no question the tariffs are a big blow to U.S. solar installers, utilities, clean energy advocates, and consumers, who rely on inexpensive panels as a driver of the ongoing renewables revolution. A slowdown in purchasing seems likely and has probably already occurred as companies were gearing up for this decision. According to some analysts, the tariffs could increase solar panel costs by 10 to 12 cents per watt (for reference, U.S. import prices are currently at 35 to 40 cents per watt), which could slow the market by an estimated 8.3 percent.

But the extent of the damage may not be as severe as industry predicts, for three main reasons:

- U.S. solar manufacturers will greatly benefit from this decision and potentially expand their market share to make up for the lost imports and bring down costs through scale.

- Solar industry predictions may have been overstated to scare the administration from imposing high tariffs. We’ve certainly seen industries issue dire warnings about the effects of various environmental policies on consumer prices, for example, only to have those predictions not come true — indicating that industry is prone to hyperbole to achieve policy aims.

- Foreign manufacturers may respond by locating some of their (mostly automated) solar panel factories here in the U.S. to avoid the tariffs. Due to automation, such moves likely wouldn’t produce a lot of new jobs here, but it would enable the panels to remain inexpensive.

In the long term, this decision is another indication of how the U.S. is ceding ground to other countries on clean technology. Just as the efforts to roll back federal fuel economy standards will push the electric vehicle market to countries like China, this decision on solar panels means the rest of the world will continue to take advantage of the solar PV revolution, leaving the United States as bystanders in this growing industry. Despite the decision though, many U.S. states will continue to invest heavily in solar PV, due to mandates for procurement. But individual home and business owners may have a tougher time getting good deals on rooftop solar.

It’s a cliche, but elections have consequences, and this is a big one from the 2016 presidential election. But it also means that a future election can undo some of the damage to the solar industry from these tariffs. And an affected foreign country can also appeal the tariffs to the World Trade Organization. In the meantime, we’ll have to wait and see how the industry — and consumers — respond to this decision.

With a rough 2017 on the environment now in the books, here are the top issues I plan to follow in 2018 on climate change:

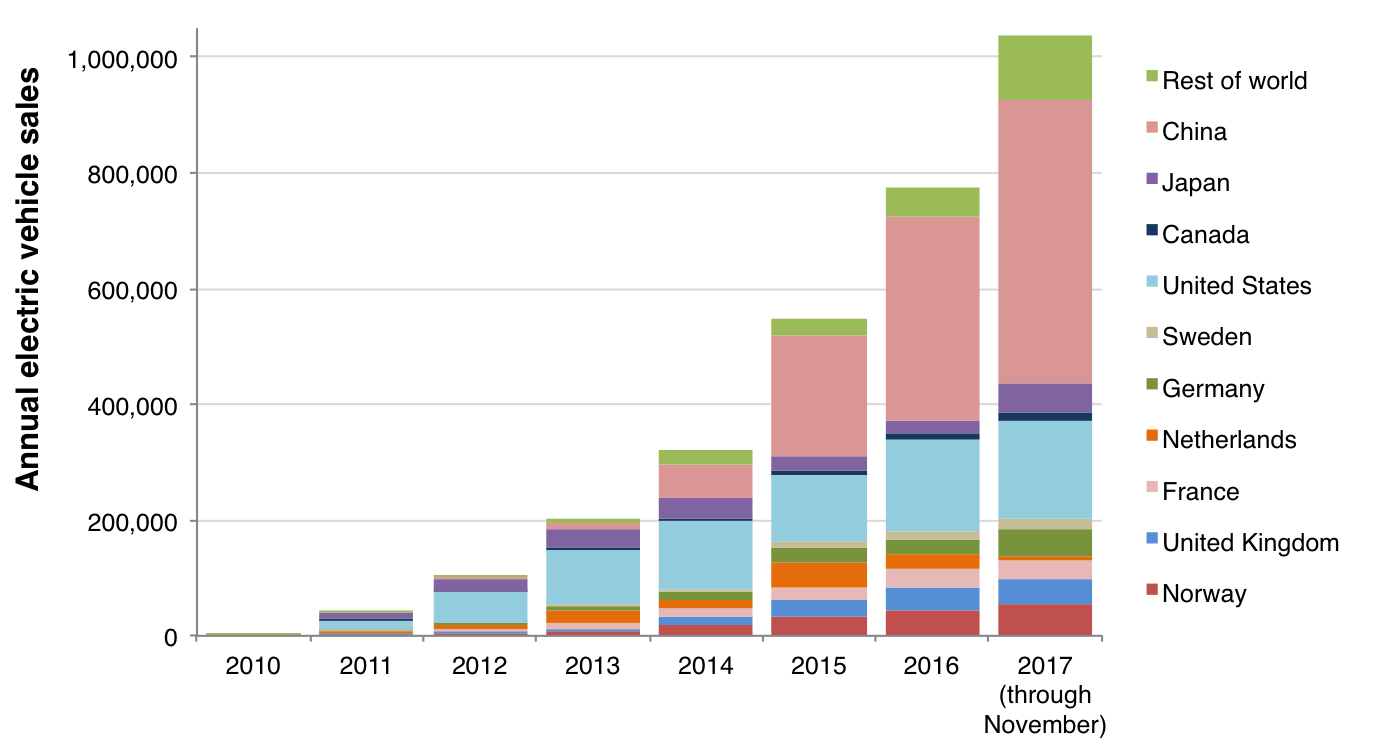

- A possible boost for electric vehicles from new models and global demand: With the more affordable Tesla Model 3 finally trickling out, plus aggressive EV policies in countries like China, hopefully we will see continued increases in demand for electric vehicles. Here’s an interesting chart on EV adoption worldwide, illustrating in particular the pivotal role that China is playing:

- Impacts of potential oil price increase: OPEC nations have already decided to cut oil production, which could mean that prices will increase with less supply (perhaps even despite more pumping from the U.S. and Russia). If oil prices rise, gas prices will go up, possibly leading to more demand for electric vehicles and other fuel-efficient vehicles and a decrease in pollution.

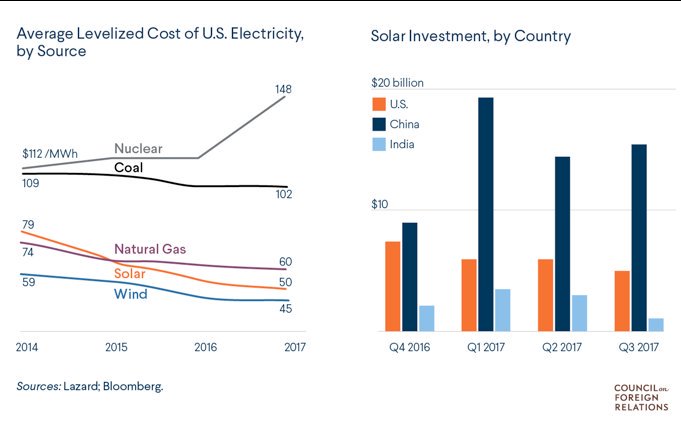

- Renewable energy’s political headwinds and tax uncertainty, coupled with falling costs: The Trump administration is doing everything it can to boost coal and undercut renewables (particularly with likely tariffs coming on foreign solar panels). And the 2017 federal tax legislation creates uncertainty for wind and solar tax credit financing going forward. But the economics of renewables continues to defy expectations. Here’s a chart with some more details on the rapid progress made in the past few years, including just in 2017:

- More extreme weather & environmental challenges: 2017 was a doozy on extreme weather, with another record-breaking temperature year that included brutal wildfires and hurricanes like we’ve never seen. As the climate continues to warm, expect more of these events, with the potential for them to change the politics around climate. Special mention: the impact of Puerto Rican refugees on Florida politics.

- U.S. state action to fill the federal void on climate leadership: States (and many cities) are continuing to move aggressively on climate. Will we see more states join California’s cap-and-trade program or implement strong greenhouse gas emissions reduction targets, including carbon taxes? Will we see multi-state collaborations on climate? This year could provide some opportunities for state gains on climate leadership, particularly in states like Oregon and Washington, plus the continued possibility a regional western-wide grid to facilitate renewable deployment across the western U.S.

- 2018 mid-term elections: A Democratic takeover of at least the House, if not the Senate, would dramatically change the prospects for climate policy in the country. A Democratic House means the purse strings could swing back in favor of funding environmental measures, plus some congressional oversight on agency action (or inaction or worse, in the case of climate change). A Democratic Senate could in turn mean much more moderate judicial nominees who hear cases on agency decision-making on the environment.

Honorable mention: California housing policy. While 2017 was supposed be the “Year of Housing,” much more work remains to be done. Will California legislators finally start to rein in local control over land use, which has prevented sufficient infill housing in thriving metropolises from getting built? And relatedly, will California voters overturn in November the state’s new gas tax increase, which helps fund transit and road repair to serve infill housing?

Lots of interesting issues to follow this year. Thanks for reading this blog — I look forward to covering them all and more in 2018.

A common knock on California’s climate programs is that they often end up disproportionately benefiting the wealthy. From cash rebates for Tesla drivers to lower electricity rates for single-family homeowners with solar panels, there was some truth to the complaint.

A common knock on California’s climate programs is that they often end up disproportionately benefiting the wealthy. From cash rebates for Tesla drivers to lower electricity rates for single-family homeowners with solar panels, there was some truth to the complaint.

But in the last few years, the legislature and other state leaders have made efforts to expand the benefits of these programs to low-income Californians. Rebates for electric vehicles, for example, are now means-tested and not available to high-income residents, and at least 25 percent of cap-and-trade auction proceeds must go to disadvantaged communities.

Now residential solar incentives are part of the mix, too. The California Public Utilities Commission just approved spending $1 billion in cap-and-trade dollars over the next 10 years on incentives for landlords to install rooftop solar panels on apartment buildings housing low-income residents. The San Jose Mercury News has more details.

Overall, the program seems like a smart investment, given that multifamily dwellers (especially of the low-income variety) are otherwise cut out of these opportunities if they don’t own their roofs. Politically it also gives more Californians a stake in the state’s climate programs, which helps build public support to keep the programs stable.

But it would be nice to see this program bundled with energy efficiency incentives. Just like solar is a tough nut to crack, given the split incentives among landlords who own the building and the tenants that pay the bills, so is energy efficiency work, which should be the first priority to save energy. Bundling efficiency incentives with solar could make landlords more open to doing this retrofit work, as well as making it more economically effective.

I’d also note that overall, California’s climate programs are benefiting the economy and creating jobs in some of our most disadvantaged regions, including the San Joaquin Valley and Inland Empire, as we studied in reports this year. And as wealthier residents purchased clean technologies like electric vehicles and solar panels when they were expensive in the early years of production, they’ve helped bring the costs down to the point where these technologies are now affordable to many millions of Californians.

But overall this solar incentive program is a good step in the right direction, and a harbinger of more climate programs to come that will benefit the state’s low-income residents.

Last month, while many environmental leaders went to Bonn, Germany for the U.N. climate talks, I journeyed to the Caribbean island of Aruba for the Green Aruba 2017 energy conference to speak on an environmental panel.

Last month, while many environmental leaders went to Bonn, Germany for the U.N. climate talks, I journeyed to the Caribbean island of Aruba for the Green Aruba 2017 energy conference to speak on an environmental panel.

Before going, the only thing I knew about Aruba was that it was the first lyric in the 1988 Beach Boys hit Kokomo. But it turns out Aruba is a leading island on clean energy in the Caribbean. And that’s a big deal.

As the Clean Energy Finance forum detailed, small islands are often perfectly positioned to benefit from a transition to clean energy:

- First, they typically pay a lot of money for dirty electricity, as they usually rely on imported oil to burn to generate power. This leaves them vulnerable to price shocks.

- Second, they often have abundant renewable resources from sunshine, wind, wave and sometimes geothermal and biomass.

- Third, they need to be more resilient in the face of extreme weather anyway, so relying on locally generated power for a decentralized grid is an important resilience strategy (a need that’s become clear with Puerto Rico’s continued blackout in the aftermath of Hurricane Maria). Moody’s even recently rated some of these islands as risky for investors due to their exposure to climate events, per Bloomberg.

Aruba is one of the best positioned to go green. The island is relatively wealthy, as it pivoted from an economy heavily dependent on oil refining in the 1980s to one big on tourism. Many Americans from the East Coast spend a lot of money there, given the picturesque beaches, pleasant weather (very little rain and almost no hurricanes), and the ability to use dollars and get by with English on the island (it’s a former Dutch colony with a local Papamiento language, but everyone learns English).

The island’s political leaders committed in 2012 to a 100% clean energy goal by 2020. As a result, the utility has been a leader in investing in renewables, with plans for more. The island residents and visitors use about 100 megawatts of electricity, and a wind farm on the windy north coast, which is mostly in the national park, generates 30 megawatts of power. They also built a 4 megwatt solar park at the airport. Together with some other resources, the island can credibly generate 40% of their power from renewable sources, depending on the sun and wind. Plans going forward include another wind farm, Tesla batteries, more solar, and a waste-to-energy facility.

But notably, these projects have faced some community opposition that might be familiar to clean energy advocates elsewhere. The new wind farm, for example, is proposed in a major bird area, as local bird expert and activist Greg Peterson told me. With land in limited supply, and increasing development pressure from a growing population and economy, birds and other wildlife are suffering on the island. So island leaders will need to find a way to develop clean resources in a way that preserves Aruba’s wildlife and natural beauty.

But despite these conflicts and pressures, Aruba is a pioneer on green energy and a leader for other island nations to follow. And if the island is successful in achieving its 100% clean energy goal, it will be a leader for larger countries like the U.S. as well.

Meanwhile, to get a taste of the conference, here is a video of a workshop for youth held the day before the formal conference began. As you can see, Aruba is worth visiting for more than just the beaches and weather, given its green energy policies.

Republicans from the House and Senate last week unveiled their compromise conference tax bill. Due to intense lobbying efforts, Republican negotiators seem to have reduced some of the harm I described for renewable energy, electric vehicles, and affordable housing. As Brad Plumer in the New York Times writes, support for renewables is now bipartisan, as Republican states like Iowa produce a lot of wind power, while states like Ohio and Nevada with Republican senators manufacture a lot of clean technology equipment.

Republicans from the House and Senate last week unveiled their compromise conference tax bill. Due to intense lobbying efforts, Republican negotiators seem to have reduced some of the harm I described for renewable energy, electric vehicles, and affordable housing. As Brad Plumer in the New York Times writes, support for renewables is now bipartisan, as Republican states like Iowa produce a lot of wind power, while states like Ohio and Nevada with Republican senators manufacture a lot of clean technology equipment.

Most of the changes in the bill involve corporate tax credits, which are used to finance renewables and affordable housing. First, the conference bill removes the corporate “alternative minimum tax,” which would have made tax credits essentially moot with corporations unable to reduce their taxes below a certain amount. Second, it minimizes the damage from a new provision called the Base Erosion Anti-Abuse Tax (BEAT), which seeks to prevent multinational companies from claiming a portion of production or investment credits. The conference bill allows the credits to offset up to 80 percent of the BEAT tax, which helps preserve the market for the credits among multinational companies (Utility Dive offers a good overview of the details of these provisions).

Wind power is still hurt by the bill, given that the new provisions do not cover the full duration of production tax credits that finance these projects. And by reducing corporate tax rates overall, the bill decreases corporate “tax appetite” that helps drive demand for the tax credits. But it could have been much worse.

Meanwhile, the conference bill continues the tax credit for electric vehicle purchases, which is set to phase out for each automaker anyway based on sales (but the bill reduces tax incentives for transit and biking). This credit has been very important to boosting demand, as University of California, Davis transportation researchers have documented.

Finally, on affordable housing and other infill projects, the draft legislation would preserve most of the tax credits used to finance these projects. It retains the low-income housing tax credits (LIHTC), continues tax-exempt private activity bonds, including multifamily bonds, which are used to finance all sorts of infill infrastructure, and saves the 20% historic tax credits. It also retains new markets tax credits and of course reduces the corporate tax rate to 21%, which presumably benefits many infill developers. You can read more on the provisions affecting housing and land use from Smart Growth America.

Presuming no new issues arise, votes on the compromise bill could come this week and possibly be signed into law before Christmas. Overall, it’s a bill that will add at least $1.5 trillion to the debt, starve government of funds to provide basic services and infrastructure, and mostly benefit the wealthy and large corporations at the expense of middle-income earners.

But for clean technology and housing at least, it went from devastating to just bad.

With more solar and wind power on the grid, we’ll need lots of energy storage to soak up any surplus power for use during windless nights or cloudy days. Batteries are getting a lot of attention, but “gravity trains” may be an option as well.

Edgylabs.com profiled a company I’ve discussed before called Advanced Rail Energy Storage (ARES):

The ARES system is basically a series of heavy concrete blocks on a railway. The excess power from the grid pushes those blocks up an incline. When demand puts a strain on the grid, these blocks are released and go back down the incline. Through the magic of regenerative braking, that kinetic energy gets converted into an extra jolt of electrical current for the grid.

Each of the trains weighs about 300 tons, and they work best on an incline grade of 7.2%. As each train moves down the incline, they pump about 50MW of power into the grid.

The obvious limitations are the need for space and inclines. But it could be a good solution for some of the hilly or mountainous regions in western states like California. I’m glad to see the company is still moving forward with its technology, as we’ll need all sort of energy innovation to solve the storage needs.

Meanwhile, you can watch this Bloomberg news segment on the company:

UPDATE: Initial reports that the electric vehicle tax credit was killed in the Senate version may have been inaccurate. The text of the amendment contained some obscure language that actually indicates that it was not adopted in the ultimate bill.

Donald Trump’s electoral college win a year ago certainly promised a lot of setbacks to the environmental movement. His administration’s attempts to roll back environmental protections, under-staffing of key agencies enforcing our environmental laws, as well as efforts to prop up dirty energy industries have all taken their toll this year.

However, until the tax bill passed the Senate this week, much of that damage was either relatively limited in scope or thwarted by the courts. But the new tax legislation now passed by both houses of Congress, and still in need of reconciliation and a further vote, could dramatically undercut a number of key environmental measures in ways we haven’t yet seen from this administration.

Originally, there was some hope that Republicans in the U.S. Senate would weaken some of the draconian environmental measures in the original House tax bill. But that was largely dashed by the late Friday night, partisan vote in the U.S. Senate. First, the bill targets clean technology while promoting dirty energy:

- The renewable energy tax credits for wind and solar are severely undercut by an obscure provision in the bill called Base Erosion and Anti-abuse Tax (BEAT), as Greentech Media reports. While analysts are still reviewing the provisions to discern the likely impact, initial assessments are that this bill language could greatly hurt the industry by decreasing the value of the credits.

- Similarly, the reinstatement of the alternative minimum tax for corporations, which was not in the House bill, also hurts the market for renewable tax credits, if not devastates it. By inserting this provision at the very last minute, Senate leaders attempted to offset some of the other tax cuts and projected deficits by ensuring corporations pay a minimum tax. The problem is that it renders many tax credits worthless, as businesses will no longer need them. Particularly hurt are wind energy projects, which rely on the production tax credit, as well as solar projects that rely on the investment tax credit.

- As a dirty cherry on top, the Senate bill opens the Arctic National Wildlife Refuge to oil drilling.

On housing, the tax bill has the potential to devastate affordable housing. Affordable projects often rely on tax credits for financing. As Novogradac & Company writes, the BEAT provision will dampen corporate investors from claiming tax credits like the low-income housing tax credit (LIHTC), new markets tax credit (NMTC), and historic tax credit (HTC), all used to fund affordable and other infill projects. Other changes in the bill promise further dampening of financing for affordable housing.

The only good news for environmental and housing advocates is that there is still a chance to make changes in the bill through the conference committee. And that the provisions here can be rescinded in 2021 with a new congress and president.

Wyoming is pretty much the Saudi Arabia of wind. In fact, Wyoming wind farms are starting to get so cheap that they can out-compete solar, gas and coal, even without subsidies.

Wyoming is pretty much the Saudi Arabia of wind. In fact, Wyoming wind farms are starting to get so cheap that they can out-compete solar, gas and coal, even without subsidies.

The financial firm Lazard released its most recent Levelized Cost of Energy Analysis, an annual report of different energy sources and their costs, which shows this progress in hard numbers. It documents that new wind power costs between $30 and $60 dollars per megawatt hour in levelized costs. And with the federal tax subsidy included, the cost of new wind falls to between $14 and $52 (Wyoming does even better than most places on cost because the state is just so windy next to the Rocky Mountains).

By comparison, coal had a higher cost of between $60 and $143 per megawatt hour, while a combined cycle natural gas plant’s cost was between $42 and $78 per megawatt hour, cheaper than coal but not as cheap as wind. Nuclear was way high, between $112 and $183.

The result of these numbers is a booming wind industry in the Cowboy State, as Heather Richards of the Casper Star-Tribune reports:

Developers Power Company of Wyoming and Viridis Eolia both have significant wind projects proposed in the state. Power Company’s Chokecherry Sierra Madre wind farm is under construction for the first phase of a 1,000 turbine farm near Rawlins. And Rocky Mountain Power, the state’s largest utility, would like to repower their entire wind fleet in the state, as well as bring 1,100 new megawatts online.

But the coal industry is not happy about it. The state’s coal sector is still the largest in the country, despite this new competition, and it’s facing considerable pressure from cheaper fuel sources both traditional and renewable. The industry hates the federal tax credit for wind and even got the state to levy a separate tax on wind production.

But with costs continuing to fall, plus the prospect of Wyoming serving out-of-state renewables market in places like California (should California successfully regionalize its grid), the coal industry’s fate will be unavoidable. In the long term, that’s not only good for air quality and stabilizing the Earth’s climate, it will also diminish the political power of the industry to try to hurt clean energy through bad tax policy, whether at the state or federal level.