Just like the developing world has leapfrogged wealthy countries with telecommunications — jumping right to cell phones over land lines — it may be doing the same with clean electricity grids.

Just like the developing world has leapfrogged wealthy countries with telecommunications — jumping right to cell phones over land lines — it may be doing the same with clean electricity grids.

Greenbiz reports on some of the microgrids being deployed in developing countries like Haiti, involving solar, some energy storage, and “internet of things” monitoring and control for customers. Essentially, the software can deploy specific amounts of electricity to individual customers based on their needs, like lighting and television watching. If they don’t pay, they lose service, but can restore it the next day if they have the money:

“We started with the idea that the poorest people in the world make the shrewdest financial decisions,” said [business owner] Thakkar. And he believes they have proved their point.

“Our first customer was an old gentleman in a small village. Everyone in the village came out to listen to our presentation. He asked two or three questions and then went back in his hut and came out with 1,000 rupees, which was the equivalent of about $20. He said, ‘Great, give it to me,'” he recalled of the 2008 start of the company.

The big difference in these low-income markets is that many customers just want basic electricity service for things like lights and charging phones. Obviously, developed markets have much more intense electricity needs.

But by scaling the market at this initial step, we’re learning what works and what doesn’t. And as costs come down and the business model proves itself, it could become a model that scales to the developed world. While the vision of communities going completely off grid may still be impractical or too expensive, these developing world examples show that we can get pretty far along that path. And with new technological breakthroughs, it could one day even enable a complete break with the traditional grid model even in the developed world.

Today is a pretty big day in the world of U.S. environmental policy. The D.C. Circuit Court of Appeals will hear oral argument on state challenges to the U.S. Environmental Protection Agency’s “Clean Power Plan.” The Plan, promulgated under existing Clean Air Act authority, represents one of the centerpieces of the Obama Administration’s efforts to combat climate change. It also underlies the U.S. commitment to the Paris climate agreement signed in December.

So the stakes are high. Folks were lining up early to get a spot in the courtroom today, as Denise Grab of NYU Law’s Policy Institute tweeted at 5:30am:

75+ people already in line at 5:30 am in the rain for #CleanPowerPlan oral argument. That’s dedication. pic.twitter.com/gvblZqAefp

— Denise Grab (@denisegrab) September 27, 2016

The court debate will hinge on whether or not the EPA is limited to only regulating sources like power plants “behind the fence line” — in other words, only requiring on-site emissions reductions technologies — or whether the EPA can require grid-wide emissions reduction policies, like cap-and-trade or energy efficiency programs.

My UCLA Law colleagues Ann Carlson and Cara Horowitz, along with William Boyd (University of Colorado Law), describe the basic argument here on Legal Planet:

The Clean Power Plan uses the grid’s interconnectedness to reduce power-sector emissions in an efficient, effective way. The Plan would cut carbon dioxide emissions significantly by 2030 – to about a third below 2005 levels. The rule justifies that level of reduction by calculating, among other things, the potential for shifting generation toward low- and zero-emitting sources and away from coal-fired power plants. Yet the coal industry and conservative attorneys general who are challenging the CPP claim that we should ignore the interconnected electricity machine and treat its component parts – power plants – separately.

The case magnifies the intensity of the coming presidential election. Regardless of the outcome today, the case will likely be appealed to the U.S. Supreme Court. Due to a Republican senate blockade on Merrick Garland, President Obama’s pick to fill the open seat from Antonin Scalia’s death last February, the court only has eight justices. A 4-4 tie on this appeal will let the circuit court opinion stand.

So whichever candidate is elected president and fills that seat (or causes Republicans to buckle and confirm Garland in the lame duck session) will have a major impact on the national and international climate fight.

And as last night’s presidential debate showed, the candidates diverge sharply on this issue. Hillary Clinton was the only candidate to mention clean energy jobs and attack Donald Trump for his past statements on climate change as a hoax by the Chinese to gain a competitive advantage. He denied making that claim, but his 2012 tweet says otherwise. Meanwhile, his campaign manager affirmed today that he doesn’t believe in the science that humans are causing climate change.

So the choice could not be clearer on this issue in November. And the court decision stemming from oral argument today will loom large, regardless of how much the media pays attention to climate change during this campaign.

Hawaii and Nevada represent two states pioneering a “post-net metering” world for rooftop solar. Collectively, they’re providing some interesting learning experiences for the rest of the country.

Many other states have traditional net metering, in which any surplus rooftop solar energy you produce for the grid is credited at a full retail rate on your bill. But Hawaii and Nevada utilities have successfully pushed back on that approach, convincing state regulators to diminish or even gut the incentives.

First, Hawaii: the state has significant rooftop solar uptake, with a nation-leading 17% of all customers in the main utility’s service territory. But the utility there has been trying to fight further proliferation with the usual arguments related to reliability and cost.

First, Hawaii: the state has significant rooftop solar uptake, with a nation-leading 17% of all customers in the main utility’s service territory. But the utility there has been trying to fight further proliferation with the usual arguments related to reliability and cost.

The state’s regulator has largely followed the utility line, ending net metering and replacing it with two options. The first is a fixed rate payment for surplus power that is less than the full retail credit, called a “grid supply” option. The second is a “self-supply” option that features a minimum bill and only some surplus power allowed back on the grid.

Perhaps not surprisingly, the fixed rate “grid supply” option has been the most popular. But regulators imposed a cap on that program, which the islands have already started to bump up against. As a result, solar companies are lobbying hard for regulators to raise the cap. But even if they raise the cap, the long-term problem isn’t going away.

So that’s why it’s interesting to see the market in Hawaii respond with technology packages to help spur demand for the self-supply option. As Utility Dive reports:

Other solar developers like Sunrun and SolarCity have rolled out offerings aimed at the CSS [self-supply] option. SolarCity’s product is a combination of storage, solar systems and a Nest thermostat, water heater and controller, allowing consumers to use more of their energy onsite.

The savings are significant, according to Mark Dyson from Rocky Mountain Institute. By using the product, customers could “save 33% on their electricity bill, “which amounts to “nearly 80% of the savings that the old NEM arrangement offered.”

Sunrun’s Brightbox is another option. The company teamed up with Tesla to offer solar-plus-storage system, a much simpler one than SolarCity. While the first Brightbox installation occurred earlier this year, the company plans to roll out this offering in full force before the end of the year.

Both offerings could receive a boost if a group of energy storage bills reappear in the next legislative session, bringing down the cost of storage installation through extending tax credits, offering rebates or both.

So in Hawaii, we may end up seeing a combination of smart new policies and technology and financing packages that can make a post net-metering world viable there for distributed clean technology.

Nevada, meanwhile, is pulling back from the brink a bit. The state’s electricity regulators had previously yanked all solar incentives — not just for new customers but for existing ones that already plopped down thousands of dollars (in some cases) for rooftop PV.

But now a deal seems to have been worked out to soften the harsh retrenchment. Per the Reno Gazette-Journal:

NV Energy reached an agreement with the Public Utilities Commission of Nevada, Bureau of Consumer Protection and SolarCity to grandfather eligible customers under previous rates for residential rooftop solar that featured lower fees and higher reimbursement rates for the energy produced. The rates were hiked in December and also retroactively applied to existing customers.

“NV Energy’s intent with its grandfathering proposal was to offer a solution for customers who installed or had valid applications to install rooftop solar systems … in the most efficient and timely manner,” the company said in a statement. “We appreciate all parties coming together to expedite the process on behalf of our customers.”

The grandfathering agreement will apply to about 32,000 customers, including those who had a pending application on Dec. 31, 2015. Customers who withdrew a valid application or had their application for the RenewableGenerations expire between Dec. 21 and Dec. 31 are eligible to be grandfathered as well. The agreement still must be approved by the PUC, which is expected to vote on it on this week.

It’s a welcome development for those existing customers, who were treated unfairly by the abrupt policy change. But more will be needed to rescue the state’s rooftop solar industry, which has been annihilated by the new policy. Perhaps Nevada may need to consider a policy more like Hawaii’s grid-supply option as a compromise. But in the meantime, a ballot measure backed by the solar industry could reinstate solar incentives, if voters approve.

All in all, both states provide glimpses of a possible future for state rooftop solar incentives. While some experimentation is happening there, at least in Hawaii, it’s clear that they both need to improve their policies to keep rooftop solar — and the environmental benefits that flow from it — alive and well.

Utilities may hate rooftop solar for cutting into their profits, but they seem to like community solar. In these arrangements, consumers buy into a local solar PV project that could be small enough to fit on a Little League field. The local utility buys the electricity and then reduces the customers’ electric bills based on how much the utility purchases.

Utilities may hate rooftop solar for cutting into their profits, but they seem to like community solar. In these arrangements, consumers buy into a local solar PV project that could be small enough to fit on a Little League field. The local utility buys the electricity and then reduces the customers’ electric bills based on how much the utility purchases.

This is a great option for renters and apartment dwellers who don’t have their own roof space and therefore no access to their own solar arrays.

Bloomberg reports on the new wave of community solar taking off like rooftop did:

“Utilities see community solar as a bit more friendly,” said Drew Warshaw, vice president of community solar at NRG Energy. “By definition we have to use their transmission and distribution system, we pay for any upgrades needed and they continue to have a relationship with the customer.”

Still, utilities are closely watching how this initiative plays out, mainly related to lost revenue, according to Chief Executive Officer Jim Torgerson of Avangrid Inc., which owns utilities in New York and New England.

“Shared solar has much better economies of scale than rooftop but net metering issues really have to get resolved,” he said in a phone interview. “We think it’s worth the wholesale price of power, not the retail rate.”

Even with this utility hesitancy, the future for community solar seems brighter than for rooftop, given the more pro-utility bent of the contracts. So right now utilities may be okay with the arrangement.

But it may just be a matter of time before the technology improves enough to displace traditional large-scale utilities. As solar and battery prices come down, many communities will be able to essentially become their own utilities, with links to neighboring microgrids.

If that comes to pass, community solar may hasten the end of the traditional utility.

Navigant’s William Tokash envisions the possibilities with the proposed SolarCity-Tesla merger:

Navigant’s William Tokash envisions the possibilities with the proposed SolarCity-Tesla merger:

A key aspect of technology innovation in renewable energy has been financing innovation. The development of power purchase agreement financing has been instrumental in the growth of solar PV. Navigant Research believes that financing innovation will also drive energy storage markets over time, as well. But the new Tesla could be uniquely positioned to apply financing innovation to an integrated solar battery PEV-based VPP [virtual power plant] while also providing consumers with the use of the vehicle. Imagine a homeowner entering into a 15-year financing agreement for solar, energy storage, and use of a Tesla Model 3 under a single contract. In this scenario, the new Tesla/utility partner manages the VPP asset while the customer gets access to, but not ownership of, a Tesla Model 3.

This financing arrangement could spark a real breakthrough in deploying more clean technologies. The issue for climate and clean tech, as Jigar Shah recently wrote to Bill Gates, is less about technology innovation at this point and more about how we actually start getting these technologies financed and built.

The proposed merger could get us farther down that road than we’ve been before, at least for home and business solar+storage, coupled with EVs in the garage.

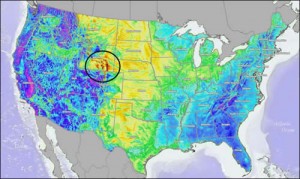

A grid based largely on renewable energy will be tough to manage, given the intermittency of solar and wind power. That’s why it’s in California’s interest to expand its grid to cover the greater western United States. With a western market, California can sell cheap surplus renewables to other states and import their renewables when we don’t have enough.

A grid based largely on renewable energy will be tough to manage, given the intermittency of solar and wind power. That’s why it’s in California’s interest to expand its grid to cover the greater western United States. With a western market, California can sell cheap surplus renewables to other states and import their renewables when we don’t have enough.

To that end, California’s grid operator, the California Independent System Operator (CAISO) has proposed expanding to acquire PacifiCorp, a grid operator with transmission assets in five additional western states.

As I’ve discussed before, this expansion is not without controversy. PacifiCorp states are worried about losing sovereignty to a California-heavy expanded grid operator, while environmentalists are worried that the expansion will throw a lifeline to some coal-fired power plants in the PacifiCorp territory.

California officials are also worried that grid expansion could open up avenues for legal challenges and loss of sovereignty over the state’s domestic climate policies, particularly on renewable energy procurement. Specifically, would expansion increase the federal government’s ability to preempt state authority over domestic policies and energy contracts through the Federal Energy Regulatory Commission (FERC)? And would expansion open up California to legal challenges that claim that state policies in an expanded grid violate the commerce clause in the U.S. Constitution?

To evaluate these concerns, CAISO commissioned a legal analysis by UCLA Law’s Ann Carlson and University of Colorado Law’s William Boyd, in consultation with me and my Berkeley Law colleague Dan Farber. That analysis was released publicly yesterday afternoon, and you can read it here [PDF].

Here is what we found, in a nutshell:

The straightforward answers to each of these questions are that the inclusion of PacifiCorp assets in CAISO:

1) would not alter FERC’s jurisdiction and would not displace any existing state authority over environmental matters. CAISO is already subject to FERC jurisdiction and the inclusion of PacifiCorp in CAISO does not change this. FERC does not have jurisdiction over California’s energy and environmental policies and this would not change because of the inclusion of PacifiCorp in CAISO;

2) would not alter the constitutionality of California’s environmental and clean energy laws under the Commerce Clause of the United States Constitution because the policies are already subject to Commerce Clause scrutiny.

To be clear, this memo doesn’t address other potentially thorny issues, such as how the governance structures will be arranged in this future entity and how specific issues like the coal-fired power plant fleet might be treated. But it does provide assurance that expansion will not call into question California’s sovereignty over its clean energy policies, in terms of its constitutionality and ability to operate under federal jurisdiction.

I’m back from vacation, and while a lot has happened since I was away, the big story seems to be the unveiling of Tesla’s 2.0 master plan — at least on the environment and energy front. The key stand-outs for me are:

- The diversity of transportation modes that Tesla wants to electrify: It’s not just about passenger vehicles anymore, as Tesla wants to build buses and cargo trucks, too. And of course, the expansion into pickup trucks and compact SUVs are noteworthy.

- Autonomous driving will take a while: Musk writes that while the technology is being tested, regulatory policies are still way behind, especially taking into account all the jurisdictions around the globe. He anticipates another 5 years or so before fully autonomous vehicles are allowed everywhere.

- The big play on residential and commercial batteries for solar: the new acquisition of SolarCity has solidified this approach, but the master plan is clearly betting on solar incentives changing across the country. Right now it’s a pretty good deal to get rooftop solar in most places, but there are no incentives to capture surplus solar in a battery as long as customers are getting full retail credit from their utility for it. Musk seems to betting that retrenching these incentives, as Nevada and Hawaii have done, will become the norm and will therefor provide an opportunity for batteries. It could also set up Tesla as a bit of an opposition force to traditional solar installers in these state battles, as those companies generally don’t want solar incentives shifted to batteries.

I’ll have more thoughts soon in particular on the Tesla play for buses and transit. But in the meantime, Musk has given the public a lot to chew on.

The proposed merger between Tesla and SolarCity has a lot of Wall Street types grumbling. But as I wrote a few weeks ago, the deal makes some sense in the short run and has the outside potential for major gains unlike anything we’ve seen in the energy space.

Now the Chicago Tribune spells out some of the specifics of the upside for the company, much of which is predicated on likely policy changes to solar policy in the U.S.:

Net metering rules, which require electric utilities to buy back rooftop solar from customers at retail rates, are the biggest U.S. subsidy for solar power. But as solar power spreads, the policy will begin to destabilize grid economics. Several states have reversed their rules already, most notably Nevada, where the abruptness of the turnabout left customers in the lurch with overbuilt solar systems and no way to recoup costs. Higher-capacity battery storage will eventually allow solar customers to profit from their solar systems with or without net metering. It’s investment security for the homeowner.

Essentially, Tesla is betting — with good reason — that states will likely start encouraging battery installation along with solar panels.

The article also notes that Tesla may be able to aggregate all of its customers’ battery power to sell this flexible resource to the wholesale electricity market to provide various grid services, distributing the revenue to its customers in the form of reduced energy bills or cash payments.

My only quibble is that the “frequency regulation” market that the article cites is lucrative but relatively small. So the company may have better success aggregating all this flexible demand to be responsive to grid needs (essentially to match renewable generation).

So in the near term, Tesla can benefit by selling solar panels in its showrooms. In the medium term, it can bet on battery incentives in many states and the possibility of aggregating all of its customers’ energy resources to sell to grid operators. And in the long run, as costs continue to decline and new technologies become available, the company could very well supplant traditional utilities by managing all of your energy — and transportation — needs.

Not a bad play, all in all.

In the battle to balance California’s booming renewable generation, the state’s grid operators are actively looking to expand into other states. The effort overall promises lower costs and a market for in-state surplus renewables to other states, while allowing California to access cheap renewables from other states when our in-state supply dwindles.

But local environmental groups don’t like the prospects of keeping Utah’s coal plants in business a little longer, while in-state power providers don’t like the potential loss of energy sovereignty to California. Utah leaders in particular are now sounding peeved, per the Salt Lake City Tribune:

Although the proposal says the body of state regulators would have “primary authority over regional … policy initiatives on topics within the general subject areas of transmission cost allocation and aspects of resource adequacy,” it’s not clear how or even whether the body would interact with the CAISO board. It’s also not clear what would happen to the five sitting CAISO board members when their current terms expire. Those details would be left to a transitional committee, which would be appointed by the CAISO board. This transitional committee would be tasked with hammering out the details not included in California’s governance proposal.

Though the proposal implies that the distribution of power would be worked out down the road, the initial setup worries Kelly Francone, executive director of the Utah Association of Energy Users.

Starting with a majority of board members representing California could lead to an imbalance of power down the road, she said.

States like Utah will be angling for more say over grid operations, while California will push back and will also be trying to ensure nobody messes with its renewable energy policies. If the expansion goes forward, the power sharing will be dependent on the negotiating skills of the respective parties, leaving much of the arrangement’s governance details up in the air for now.

As has been widely reported, Tesla is making moves to buy solar installer SolarCity. The two companies have family relations, with Elon Musk’s cousins running SolarCity and with Musk serving as chairman of the board, in addition to his role running Tesla.

Does the deal make sense? At a basic level, yes (although doubts persist about the short-term economics). Tesla is already distributing its batteries through SolarCity, and many Tesla customers will be interested in solar, once their electricity bill goes up as they charge at home. So there are obvious synergies: — Tesla can advertise for SolarCity in their showrooms for example, and SolarCity can promote Tesla vehicles and batteries.

But in the long term, Musk is aiming for a monopoly on a magnitude we’ve rarely if ever seen before, outside of the old company town. Essentially, Tesla seeks to own your transportation and home energy, all in one corporate clean energy “ecosystem.” It will become your utility, car company, and gas station, all in one — only without the emissions of our current system.

Musk is a friend and former business partner of Peter Thiel, the famed PayPal investor who preaches the virtues of such monopolies. Thiel essentially argues that if you’re an entrepreneur starting a business that isn’t aimed at becoming a monopoly, you’re basically wasting your time. Think Google and Amazon.

It’s hard to argue with the pure business logic of that approach (leaving aside the traditional arguments against monopolies). And now Musk seems to be following through on that approach with this takeover effort — a monopoly pattern that already started with Tesla’s decision to own its own charging network, rather than let third party companies take over, and to bypass auto dealers in favor of direct sales. At least from an environmental perspective, it would certainly herald a big win.

But will it work? Not in the short term. SolarCity will not be replacing electric utilities anytime soon. And batteries plus solar will not allow most people to leave the grid entirely. You simply can’t generate enough power or store it to cover most people’s needs throughout the year. And many people don’t own their own homes or have their own rooftops to make this possible.

But two trends could change that dynamic. First, technologies can improve, leading to more powerful solar panels and cheaper, bigger batteries. New technologies, such as cheap fuel cells, could also provide the additional generation needed to fill the solar gaps during the nighttime and winter. These developments could allow Tesla/SolarCity to become the ultimate monopoly it dreams of, particularly if it can operate at a neighborhood scale for those without dedicated rooftops.

Second, Tesla/SolarCity could buy up other companies to fill the gaps, such as energy efficiency companies and different renewable generators, like urban wind turbine manufacturers.

All in all, it’s a big gamble but with a very logical long-term goal. In the short term, the co-marketing and co-distribution opportunities could cover the costs of the merger. And in the long term, it has the outside chance of turning this country into the United States of Tesla, whether we like it or not.