The people who deny climate science the most aren’t stupid, but actually are among the smartest, a new study confirms. Previous studies I’ve blogged about have documented this phenomenon, and now a new study in the Proceedings of the National Academy of Sciences documents the trend on a range of scientific — yet politicized — issues.

The people who deny climate science the most aren’t stupid, but actually are among the smartest, a new study confirms. Previous studies I’ve blogged about have documented this phenomenon, and now a new study in the Proceedings of the National Academy of Sciences documents the trend on a range of scientific — yet politicized — issues.

As E&E news summarizes [pay-walled]:

Looking at a nationally representative survey of views on stem cell research, the Big Bang, human evolution, nanotechnology, genetically modified organisms and climate change, researchers at Carnegie Mellon University found that respondents with the most education and the highest scores on scientific literacy tests had the most polarized beliefs.

On climate change, the researchers found that political identity was a more important signal of where respondents stood than their academic acumen or scientific sophistication.

“Conservatives with higher scores display less concern about climate change, while liberals with higher scores display more concern,” the authors wrote. “These patterns suggest that scientific knowledge may facilitate defending positions motivated by nonscientific concerns.”

The take-home point for advocates of climate action is that more facts won’t change people’s minds. It’s not a question of ignorance that motivates this reasoning. Instead, advocates should focus on new frames to address the challenge, as well as on specific facets of climate change that don’t require someone to accept all the science around it, like reducing air pollution or addressing sea level rise.

Essentially, climate change has become an issue of tribal identity and ideology — and no longer one of fact and reason. While that’s disheartening, it’s also clarifying for understanding how to move forward on the issue.

China is infamous for its air quality problems, with pictures in global news outlets of record-breaking smog in cities like Beijing and people venturing outside in face masks. The public outcry there is part of the reason that China has embraced climate change policies that reduce emissions from coal-fired power plants, which are a major source of the pollution.

But the human impact of this pollution problem is easy to overlook for those of us who don’t know or talk to people in China. In co-teaching a climate change class this spring at Berkeley Law with some law students from China, for example, I was surprised to learn that many Chinese families spend hundreds of dollars on air filters for their apartment windows. Wouldn’t that money be better spent collectively instead, on slightly higher electricity rates from cleaner electricity sources? Yet in a country with one-party rule, they simply don’t have the option to protest at the ballot box. And when there are elections, voters are denied real choices.

Still, the government is getting the message, which is why they’ve been working with environmental attorneys from around the world to devise policies to reduce pollution. And it’s probably a big factor in the government’s decision to sign the Paris climate accords and an earlier bilateral agreement with the U.S.

But we shouldn’t overlook the personal nature of the air quality and public health challenge there. To that end, I found this documentary clip from Jing Chai called “Under the Dome” (Part 1) to be eye-opening and disturbing, from the perspective of a young mother looking out for her child’s health:

You can keep watching for further posted clips from the documentary. Let’s hope China will follow the success story of places like Los Angeles, which still suffers from smog but at a greatly reduced rate, and find cleaner skies soon.

Climate change is one of the most difficult political — let alone natural — challenges we face. It’s a relatively far-off calamity that requires action now among the entire developed and developing world, with uncertain costs associated. So how do we motivate people to act?

One option is to scare them with the worst-case scenarios. David Wallace-Wells tried this approach recently with a widely circulated New York Magazine cover story describing the absolute worst-case scenarios for climate change, starting with this intro:

It is, I promise, worse than you think. If your anxiety about global warming is dominated by fears of sea-level rise, you are barely scratching the surface of what terrors are possible, even within the lifetime of a teenager today. And yet the swelling seas — and the cities they will drown — have so dominated the picture of global warming, and so overwhelmed our capacity for climate panic, that they have occluded our perception of other threats, many much closer at hand. Rising oceans are bad, in fact very bad; but fleeing the coastline will not be enough.

Indeed, absent a significant adjustment to how billions of humans conduct their lives, parts of the Earth will likely become close to uninhabitable, and other parts horrifically inhospitable, as soon as the end of this century.

Lots of climate advocates and scientists pushed back on this approach though, arguing essentially that “despair is never helpful.”

But David Roberts at Vox.com celebrated this kind of journalism, pointing out that we need to hear more of this alarming, worst-case potential to motivate action:

It may be that there are social dynamics that require some fear and paralysis before a collective breakthrough. At the very least, it seems excessive to draw a pat “fear never works” conclusion from these sorts of data.

Second, even if it’s true that fear only “works” when it is joined with a sense of agency and efficacy, that doesn’t mean that every single instance of fear has to be accompanied by a serving of hope. Not every article has to be about everything. In fact, if you ask me, the “[two paragraphs of fear], BUT [12 paragraphs of happy news]” format has gotten to be a predictable snooze. Some pieces can just be about the terrible risks we face. That’s okay.

Finally, fear+hope requires fear.

Julie Beck at The Atlantic meanwhile reports on the counter-productive tactic of simply making people anxious, particularly via social media. While the thought may be that anxiety leads to action, it can often instead just immobilize and distract people:

Just as social media allowed fake news to spread untrammeled through ideological communities that already largely agreed with each other, it also creates containers for anxiety to swirl in on itself, like a whirlpool in a bottle.

“If you look at the right-hand side of the aisle, and the left, they’re each talking about the things they fear the most,” says Morrow Cater, the president of the bipartisan consulting firm Cater Communications. “The anxiety that you’re talking about—be vigilant!—it comes when you’re fearful.”

But the article also notes that fear-based messaging can work:

Though several people I spoke to said that fear-based appeals to action don’t work, and may even backfire, there’s actually evidence that they do work. Dolores Albarracin, a professor of psychology at the University of Illinois, did a meta-analysis in 2015 of all available research on fear-based appeals and found that overall, inducing fear does change people’s attitudes, intentions, and behaviors. She and her team did not find a backfire effect.

But the fear appeals that Albarracin studied came with recommended actions. “If the message is not actionable, then you’re not going to get effects overall,” she says.

For my part, I think the public should think about the absolute worst-case effects of climate change. While the worst-case scenario may not come to pass, we need to be prepared for the full range of impacts. Second, we’ve seen fear lead to some of the biggest mass mobilization efforts in history: namely, wars. And climate change will require a similar level of mobilization and urgency.

But I agree that fear-based messages should be paired with actions. Those steps should range from the individual (eat less red meat, install LED light bulbs, buy an electric vehicle if you need one, install solar panels, etc.) to the political (support candidates and policies that address the problem, such as carbon pricing, renewable energy and energy efficiency mandates, and transit-oriented housing).

Otherwise, anxiety without hope or a achievable remedy will be self-defeating.

The coal industry is hoping that the Trump administration will revive its sagging fortunes. I’ll be on AirTalk on KPCC radio (89.3 FM) in Los Angeles today at 11:20am PT to discuss the industry’s future. As the AirTalk page describes:

It’s no secret that environmentalists and the coal mining industry have long been at odds. But more fuel has been added to the fire, so to speak, as the Trump Administration’s Interior Department has moved to lift a moratorium on coal leases in public lands. The temporary ban was enacted under the Obama Administration, which quickly drew opposition from major mining companies.

As reported by the New York Times, about 85 percent of coal is mined from federal lands in the West, from the Powder River Basin. The basin, which includes lands in Wyoming and Montana, produces a small amount of exported coal. Trump has accused the Obama Administration of trying to stifle exports, a market which has become increasingly competitive in sales to power plants in Asia, particularly China. In the West, Vancouver has the most accessible export terminal, but more capacity is needed to stay competitive in the growing global market. And environmentalists have blocked any new developments for a terminal in the U.S.

Joining me on the panel will be:

- Mark Mills, physicist and senior fellow at the Manhattan Institute where his focus includes energy and energy technology, and a faculty fellow at Northwestern’s Engineering School; he tweets @MarkPMills

- Daniel Schrag, geochemist and professor of geology, environmental science and engineering; he is also the director at Harvard University Center for the Environment and served on President Obama’s Council of Advisors for Science and Technology (2009 to 2016)

For those out of the area, you can stream it live.

Most of us throw out old food all the time. But combined with the food waste from grocery stores, restaurants, and other businesses, it’s become a serious economic, environmental, and even moral problem. Astonishingly, researchers tell us that 40% of all food grown in the United States each year winds up in the trash.

This waste occurs while nearly 1 in 5 children in California goes to bed hungry each night. The economic losses are significant, and the waste also creates an environmental problem, as the decaying food emits potent greenhouse gases.

So what can we do differently on farms and in restaurants, grocery stores and our own homes to reduce the amount of food wasted? Join us tonight on City Visions when we explore the topic of food waste and find out what several Bay Area organizations are doing about it.

Guests will include:

- JoAnne Berkenkamp, Senior Advocate in the Food and Agriculture Program of the Natural Resources Defense Council

- Chris Cochran, Executive Director of ReFED

- Mary Risley, Founder of Food Runners

You can tune in live at 7pm on 91.7 FM in San Francisco or stream it on the City Visions website. Feel free to send me your questions for the panel directly. Hope you can join the conversation!

Last night the California Legislature scored a super-majority victory to extend the state’s signature cap-and-trade program through 2030. It was a rare bipartisan vote, although it leaned mostly on Democrats. My UCLA Law colleague Cara Horowitz has a nice rundown of the vote and its implications, as does my Berkeley Law colleague Eric Biber on the bill.

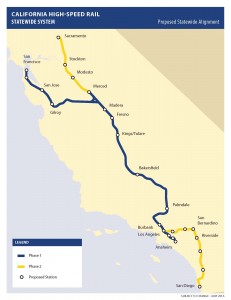

Lost in the politics is what this means for high speed rail. The system has a fixed and dwindling amount of federal and state funds at this point, and it’s relying on continued funding from the auction of allowances under cap-and-trade to build the first segment from Fresno to San Jose and San Francisco.

Lost in the politics is what this means for high speed rail. The system has a fixed and dwindling amount of federal and state funds at this point, and it’s relying on continued funding from the auction of allowances under cap-and-trade to build the first segment from Fresno to San Jose and San Francisco.

If the auction was declared invalid or ended at 2020 with depressed sales, the system would be in major jeopardy of collapsing before construction even finished on the first viable segment. Now it has some assurance of access to funds.

But of course it’s not that simple. The bill that passed yesterday has diminished available funds set aside for the programs that have been funded to date with cap-and-trade dollars. As part of the political compromises, more auction money will now go to certain carve-outs, like to backfill a now-canceled program for wildfire fees on rural development.

And another compromise may put a ballot measure before the voters, passage of which would require a two-thirds vote for any legislative spending plan for these funds going forward. That means Republicans — who generally hate high speed rail — would be empowered to veto future spending proposals.

Still, high speed rail once again has a lifeline, as do the other programs funded by cap-and-trade, such as transit improvements, weatherization, and affordable housing near transit. It’s an additional victory beyond the emissions reductions that will take place under this extended program.

Since 2009, I’ve been working with UC Berkeley and UCLA Schools of Law on an initiative to find business solutions to combat climate change, with a focus on implementing California’s world-leading climate change laws. Bank of America has been our steadfast partner and sponsor; the Bank is interested in the industries that will grow in the effort to reduce greenhouse gas emissions, with California as the perfect laboratory.

Since 2009, I’ve been working with UC Berkeley and UCLA Schools of Law on an initiative to find business solutions to combat climate change, with a focus on implementing California’s world-leading climate change laws. Bank of America has been our steadfast partner and sponsor; the Bank is interested in the industries that will grow in the effort to reduce greenhouse gas emissions, with California as the perfect laboratory.

In that time, we have:

- produced 18 policy reports;

- held multiple conferences, workshops, webinars, lunch briefings (from Fresno to L.A. to Sacramento to Washington DC);

- written numerous op-eds;

- testified in multiple legislative hearings;

- launched a new website to house all of our research and solutions; and

- had our work covered in media outlets from the New York Times to local television and radio.

While the work is rewarding in and of itself, we ultimately do it to help get climate policy right in California and to show that smart climate policies are good business, too. After all, if it can work in California, it can work anywhere and inspire other jurisdictions to follow suit.

So in a recent LinkedIn piece, I decided to describe some of this work, the impact it has had on policy, and the resulting economic and job benefits from key policies. As more of the world turns to California for climate leadership, my hope is that the resources in this initiative will be helpful not just here in our state but to the world beyond.

The California Legislature may vote on reauthorizing California’s cap-and-trade program as soon as Monday. The program needs a two-thirds vote to inoculate the auction mechanism to distribute allowances from legal challenges, which is a heavy political lift that has required a lot of compromise and concession.

But in the midst of the debate, state legislators are lacking crucial data on the impact of the program to date on some of California’s most environmentally and economically disadvantaged regions, particularly the San Joaquin Valley and Inland Empire.

But in the midst of the debate, state legislators are lacking crucial data on the impact of the program to date on some of California’s most environmentally and economically disadvantaged regions, particularly the San Joaquin Valley and Inland Empire.

To fill that gap, CLEE and the UC Berkeley Labor Center teamed up earlier this year to release a report on the economic impacts of California’s major climate programs on the San Joaquin Valley. And using the same methodology and publicly available data, we are soon to release a follow-up report on the Inland Empire, both sponsored by Next 10.

But with the vote looming on cap and trade, we wanted to release our findings on the impact of cap and trade on the Inland Empire in particular, as well as summarize our previous findings from the Valley report. Our new op-ed in yesterday’s Daily Bulletin summarizes the data:

After accounting for the costs and loss of jobs in industries required to comply with cap and trade, as well as the benefits from investments of cap-and-trade revenue, we found in the Inland Empire, the program had net economic impacts of $25.7 million, $900,000 in tax revenue and net employment growth of 154 jobs.

These net benefits do not account for funds that have been appropriated but have not yet been spent. Since only about one third of appropriated funds have so far been spent on projects in these regions, the positive impacts will only grow. When we account for the expected benefits after all funds collected are reinvested in projects, the net economic benefit reaches nearly $123 million, with 945 jobs created and $5.5 million in additional tax revenue.

We found even greater net positive impacts in the San Joaquin Valley, totaling $202 million in economic activity, along with $4.7 million in state and local tax revenue. The program also created 1,612 net jobs in the Valley. When including expected benefits after all funds collected are reinvested in projects, this figure balloons to nearly $1.5 billion in economic benefits. These projects will create 7,400 total jobs, including more than 3,000 direct jobs in the San Joaquin Valley.

We hope this information will be useful to the public and to legislators as they decide on the program’s fate beyond 2020. I will post again on the report once it’s available for release.